US Airways 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

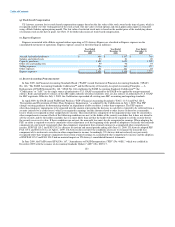

(q) Stock-based Compensation

US Airways accounts for its stock-based compensation expense based on the fair value of the stock award at the time of grant, which is

recognized ratably over the vesting period of the stock award. The fair value of stock options and stock appreciation rights is estimated

using a Black-Scholes option pricing model. The fair value of restricted stock units is based on the market price of the underlying shares

of common stock on the date of grant. See Note 13 for further discussion of stock-based compensation.

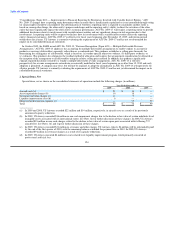

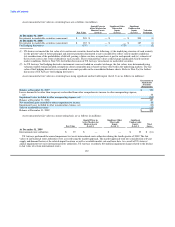

(r) Express Expenses

Expenses associated with affiliate regional airlines operating as US Airways Express are classified as Express expenses on the

consolidated statements of operations. Express expenses consist of the following (in millions):

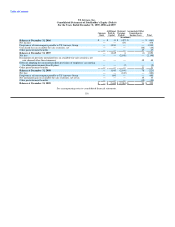

Year Ended Year Ended Year Ended

December 31, December 31, December 31,

2009 2008 2007

Aircraft fuel and related taxes $ 609 $ 1,137 $ 765

Salaries and related costs 23 21 20

Capacity purchases 1,652 1,621 1,599

Other rent and landing fees 99 96 93

Selling expenses 154 163 157

Other expenses 91 101 93

Express expenses $ 2,628 $ 3,139 $ 2,727

(s) Recent Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board ("FASB") issued Statement of Financial Accounting Standards ("SFAS")

No. 168, "The FASB Accounting Standards CodificationTM and the Hierarchy of Generally Accepted Accounting Principles — A

Replacement of FASB Statement No. 162." SFAS No. 168 establishes the FASB Accounting Standards CodificationTM (the

"Codification" or "ASC") as the single source of authoritative U.S. GAAP recognized by the FASB to be applied by nongovernmental

entities. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative U.S. GAAP

for SEC registrants. Effective July 1, 2009, the Codification superseded all existing non-SEC accounting and reporting standards.

In April 2009, the FASB issued FASB Staff Position ("FSP") Financial Accounting Standards ("FAS") 115-2 and FAS 124-2,

"Recognition and Presentation of Other-Than-Temporary Impairments," as adopted by the Codification on July 1, 2009. This FSP

changes existing guidance for determining whether an impairment of debt securities is other-than-temporary. The FSP requires

other-than-temporary impairments to be separated into the amount representing the decrease in cash flows expected to be collected from a

security (referred to as credit losses) which is recognized in earnings and the amount related to other factors (referred to as noncredit

losses) which is recognized in other comprehensive income. This noncredit loss component of the impairment may only be classified in

other comprehensive income if both of the following conditions are met (a) the holder of the security concludes that it does not intend to

sell the security and (b) the holder concludes that it is more likely than not that the holder will not be required to sell the security before

the security recovers its value. If these conditions are not met, the noncredit loss must also be recognized in earnings. When adopting the

FSP, an entity is required to record a cumulative effect adjustment as of the beginning of the period of adoption to reclassify the noncredit

component of a previously recognized other-than-temporary impairment from retained earnings to accumulated other comprehensive

income. FSP FAS 115-2 and FAS 124-2 is effective for interim and annual periods ending after June 15, 2009. US Airways adopted FSP

FAS 115-2 and FAS 124-2 as of April 1, 2009. US Airways does not meet the conditions necessary to recognize the noncredit loss

component of its auction rate securities in other comprehensive income. Accordingly, US Airways did not reclassify any previously

recognized other-than-temporary impairment losses from retained earnings to accumulated other comprehensive income and the adoption

of FSP FAS 115-2 and FAS 124-2 had no material impact on US Airways' consolidated financial statements.

In June 2009, the FASB issued SFAS No. 167, "Amendments to FASB Interpretation ("FIN") No. 46(R)," which was codified in

December 2009 with the issuance of Accounting Standards Update ("ASU") No. 2009-17,

123