US Airways 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways believes that its income tax filing positions and deductions related to tax periods subject to examination will be sustained

upon audit and does not anticipate any adjustments that will result in a material adverse effect on US Airways' financial condition, results

of operations, or cash flow. Therefore, no reserves for uncertain income tax positions have been recorded.

5. Risk Management and Financial Instruments

US Airways' economic prospects are heavily dependent upon two variables it cannot control: the health of the economy and the price

of fuel. Due to the discretionary nature of business and leisure travel spending, airline industry revenues are heavily influenced by the

condition of the U.S. economy and the economies in other regions of the world. Unfavorable economic conditions may result in

decreased passenger demand for air travel, which in turn could have a negative effect on US Airways' revenues. Similarly, the airline

industry may not be able to sufficiently raise ticket prices to offset increases in aviation jet fuel prices. These factors could impact US

Airways' results of operations, financial performance and liquidity.

(a) Fuel Price Risk

US Airways periodically enters into derivative contracts comprised of heating oil-based derivative instruments to hedge a portion of its

projected jet fuel requirements. Since the third quarter of 2008, US Airways has not entered into any new fuel hedging transactions and,

as of December 31, 2009, US Airways had no remaining outstanding fuel hedging contracts.

US Airways' fuel hedging instruments did not qualify for hedge accounting. Accordingly, the derivative hedging instruments were

recorded as an asset or liability on the balance sheet at fair value and any changes in fair value were recorded in the period of change as

gains or losses on fuel hedging instruments, net in operating expenses in the accompanying consolidated statements of operations. The

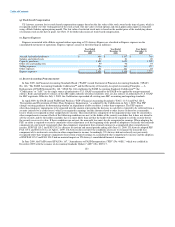

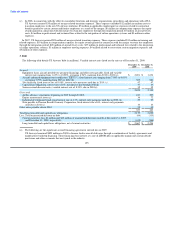

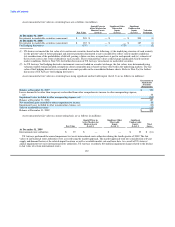

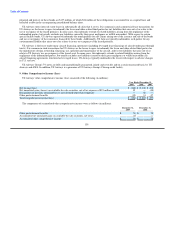

following table details US Airways' loss (gain) on fuel hedging instruments, net (in millions):

Year Ended Year Ended Year Ended

December 31, December 31, December 31,

2009 2008 2007

Realized loss (gain) $ 382 $ (140) $ (58)

Unrealized loss (gain) (375) 496 (187)

Loss (gain) on fuel hedging instruments, net $ 7 $ 356 $ (245)

The unrealized gains in 2009 were related to the reversal of prior period unrealized losses due to contracts settling in 2009.

(b) Credit Risk

Cash, Cash Equivalents and Investments in Marketable Securities

US Airways invests available cash in money market securities and highly liquid debt instruments.

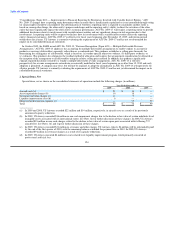

As of December 31, 2009, US Airways held auction rate securities totaling $347 million at par value, which are classified as

available-for-sale securities and noncurrent assets on US Airways' consolidated balance sheets. Contractual maturities for these auction

rate securities range from seven to 43 years, with 73% of US Airways' portfolio maturing within the next 10 years (2016 – 2017), 19%

maturing within the next 30 years (2033 – 2036) and 8% maturing thereafter (2049 – 2052). With the liquidity issues experienced in the

global credit and capital markets, all of US Airways' auction rate securities have experienced failed auctions since August 2007. The

estimated fair value of these auction rate securities no longer approximates par value. At December 31, 2009, the fair value of US

Airways' auction rate securities was $203 million. Refer to Note 6 for discussion on how US Airways determines the fair value of its

investments in auction rate securities.

During 2009, US Airways sold certain investments in auction rate securities for net proceeds of $32 million. Additionally, US Airways

recorded net unrealized gains of $58 million in other comprehensive income related to the increase in fair value of certain investments in

auction rate securities, as well as $10 million in other-than-temporary

130