US Airways 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

$38 million, as of December 31, 2009 and $54 million, $59 million and $33 million, as of December 31, 2008, respectively.

In connection with the ratification of new unified agreements that moved all of US Airways' fleet services and maintenance and related

employees to one labor contract, the Company's postretirement benefit plans were amended effective as of January 1, 2009 to include all

pre-merger AWA fleet service and maintenance and related employees.

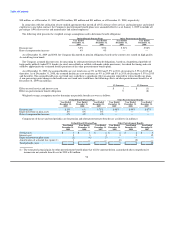

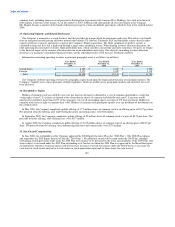

The following table presents the weighted average assumptions used to determine benefit obligations:

Defined Benefit Pension Plans Other Postretirement Benefits

Year Ended Year Ended Year Ended Year Ended

December 31, December 31, December 31, December 31,

2009 2008 2009 2008

Discount rate 5.5% 5.5% 5.51% 5.98%

Rate of compensation increase 4% 4% — —

As of December 31, 2009 and 2008, the Company discounted its pension obligations based on the current rates earned on high quality

Aa rated long-term bonds.

The Company assumed discount rates for measuring its other postretirement benefit obligations, based on a hypothetical portfolio of

high quality publicly traded U.S. bonds (Aa rated, non-callable or callable with make-whole provisions), for which the timing and cash

outflows approximate the estimated benefit payments of the other postretirement benefit plans.

As of December 31, 2009, the assumed health care cost trend rates are 8% in 2010 and 7.5% in 2011, decreasing to 5.5% in 2015 and

thereafter. As of December 31, 2008, the assumed health care cost trend rates are 9% in 2009 and 8% in 2010, decreasing to 5.5% in 2015

and thereafter. The assumed health care cost trend rates could have a significant effect on amounts reported for retiree health care plans.

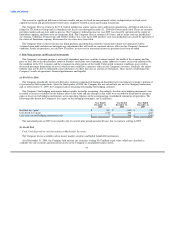

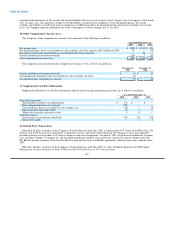

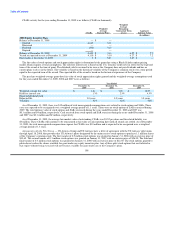

A one-percentage point change in the health care cost trend rates would have the following effects on other postretirement benefits as of

December 31, 2009 (in millions):

1% Increase 1% Decrease

Effect on total service and interest costs $ 1 $ (1)

Effect on postretirement benefit obligation 9 (8)

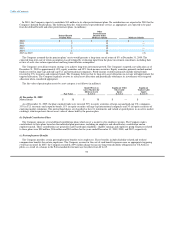

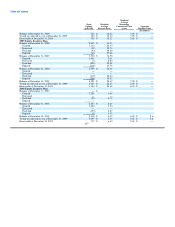

Weighted average assumptions used to determine net periodic benefit cost were as follows:

Defined Benefit Pension Plans Other Postretirement Benefits

Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended

December 31, December 31, December 31, December 31, December 31, December 31,

2009 2008 2007 2009 2008 2007

Discount rate 5.5% 6% 5.75% 5.98% 5.94% 5.67%

Expected return on plan assets 8% 8% 8% — — —

Rate of compensation increase 4% 4% 4% — — —

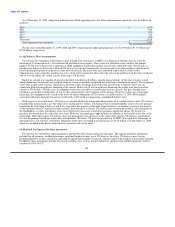

Components of the net and total periodic cost for pension and other postretirement benefits are as follows (in millions):

Defined Benefit Pension Plans Other Postretirement Benefits

Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended

December 31, December 31, December 31, December 31, December 31, December 31,

2009 2008 2007 2009 2008 2007

Service cost $ 1 $ 1 $ 2 $ 2 $ 2 $ 3

Interest cost 3 3 3 9 9 12

Expected return on plan assets (3) (4) (3) — — —

Amortization of actuarial loss (gain) (1) 1 — — (6) (2) —

Total periodic costs $ 2 $ — $ 2 $ 5 $ 9 $ 15

(1) The estimated actuarial gain for other postretirement benefit plans that will be amortized from accumulated other comprehensive

income into net periodic benefit cost in 2010 is $4 million.

98