US Airways 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(e) In 2008, in connection with the effort to consolidate functions and integrate organizations, procedures and operations with AWA,

US Airways incurred $35 million of merger-related transition expenses. These expenses included $12 million in uniform costs to

transition employees to the new US Airways uniforms; $5 million in applicable employment tax expenses related to contractual

benefits granted to certain current and former employees as a result of the merger; $6 million in compensation expenses for equity

awards granted in connection with the merger to retain key employees through the integration period; $5 million of aircraft livery

costs; $4 million in professional and technical fees related to the integration of airline operations systems and $3 million in other

expenses.

In 2007, US Airways incurred $99 million of merger-related transition expenses. These expenses included $13 million in training and

related expenses; $19 million in compensation expenses for equity awards granted in connection with the merger to retain key employees

through the integration period; $20 million of aircraft livery costs; $37 million in professional and technical fees related to the integration

of airline operations systems; $1 million in employee moving expenses; $4 million related to reservation system migration expenses and

$5 million of other expenses.

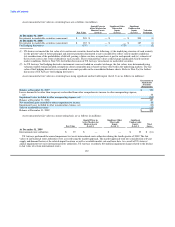

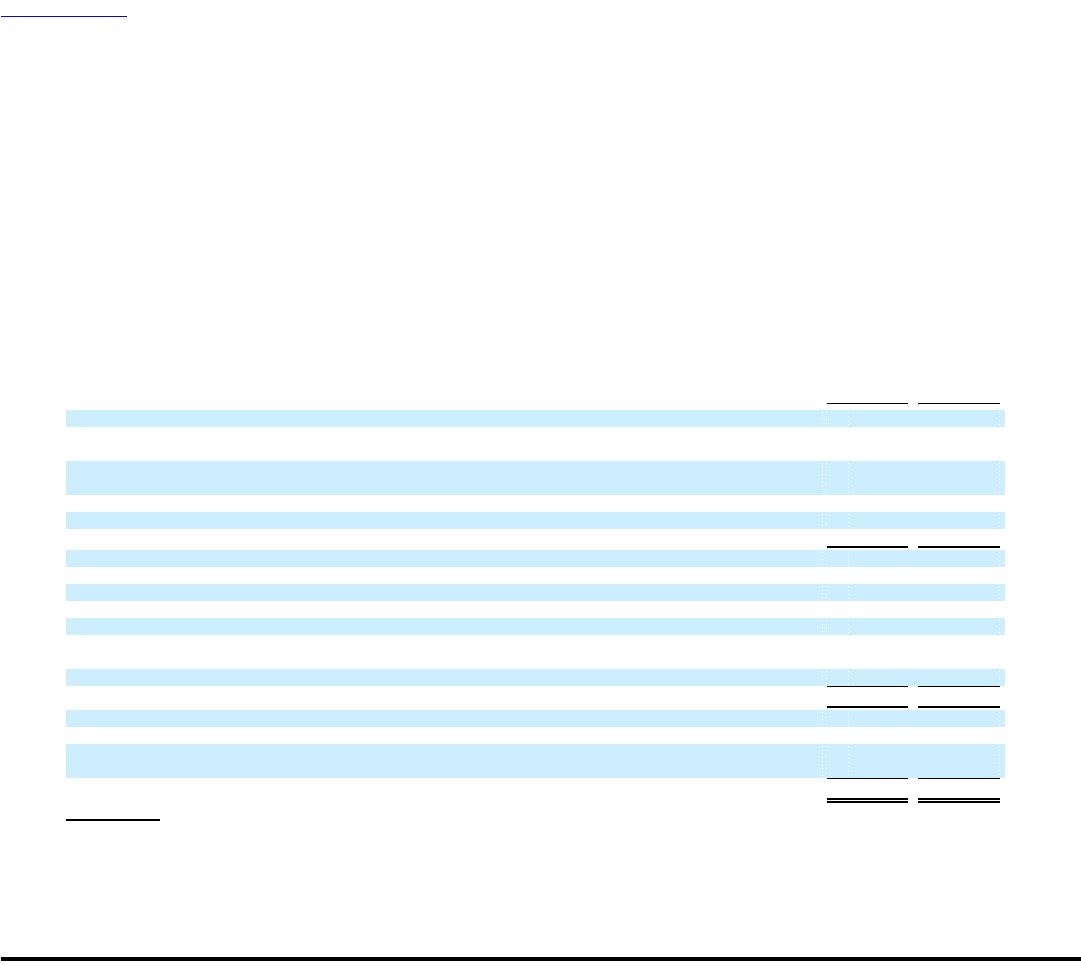

3. Debt

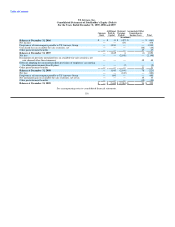

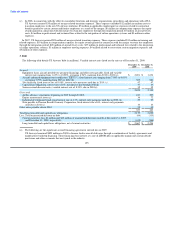

The following table details US Airways' debt (in millions). Variable interest rates listed are the rates as of December 31, 2009.

December 31, December 31,

2009 2008

Secured

Equipment loans, aircraft pre-delivery payment financings and other notes payable, fixed and variable

interest rates ranging from 1.63% to 10.28%, averaging 4.94%, maturing from 2010 to 2021 (a) $ 2,201 $ 1,674

Aircraft enhanced equipment trust certificates ("EETCs"), fixed interest rates ranging from 7.08% to 9.01%,

averaging 7.79%, maturing from 2015 to 2022 (b) 505 540

Slot financing, fixed interest rate of 8.08%, interest only payments until due in 2015 (c) 47 47

Capital lease obligations, interest rate of 8%, installments due through 2021(d) 37 39

Senior secured discount notes, variable interest rate of 8.39%, due in 2010(e) 32 32

2,822 2,332

Unsecured

Airbus advance, repayments beginning in 2010 through 2018(f) 247 207

Engine maintenance notes (g) 36 72

Industrial development bonds, fixed interest rate of 6.3%, interest only payments until due in 2023 (h) 29 29

Note payable to Pension Benefit Guaranty Corporation, fixed interest rate of 6%, interest only payments

until due in 2012 (i) 10 10

Other notes payable, due in 2010 35 45

357 363

Total long-term debt and capital lease obligations 3,179 2,695

Less: Total unamortized discount on debt (94) (113)

Current maturities, less $4 million and $10 million of unamortized discount on debt at December 31, 2009

and December 31, 2008, respectively (418) (346)

Long-term debt and capital lease obligations, net of current maturities $ 2,667 $ 2,236

(a) The following are the significant secured financing agreements entered into in 2009:

US Airways borrowed $825 million in 2009 to finance Airbus aircraft deliveries through a combination of facility agreements and

manufacturer backstop financing. These financings bear interest at a rate of LIBOR plus an applicable margin and contain default

provisions and other covenants that are typical in the industry.

125