US Airways 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

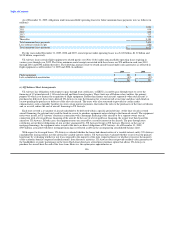

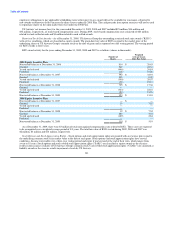

impairment charges recorded in other nonoperating expense, net related to the decline in fair value of certain investments in auction rate

securities.

In 2008, US Airways recorded $214 million of other-than-temporary impairment charges in other nonoperating expense, net. These

charges included $48 million of previously recorded unrealized losses in other comprehensive income. US Airways' conclusion for the

$214 million other-than-temporary impairment was due to the length of time and extent to which the fair value was less than cost for

certain securities. In 2007, US Airways recorded a $58 million decline in fair value. Of this decline in fair value, $48 million was deemed

temporary and recorded to other comprehensive income and $10 million of the decline was deemed other-than-temporary and recorded to

other nonoperating expense, net.

US Airways continues to monitor the market for auction rate securities and consider its impact (if any) on the fair value of its

investments. If the current market conditions deteriorate, US Airways may be required to record additional impairment charges in other

nonoperating expense, net in future periods.

Accounts Receivable

As of December 31, 2009, most of US Airways' receivables related to tickets sold to individual passengers through the use of major

credit cards or to tickets sold by other airlines and used by passengers on US Airways or its regional airline affiliates. These receivables

are short-term, mostly being settled within seven days after sale. Bad debt losses, which have been minimal in the past, have been

considered in establishing allowances for doubtful accounts. US Airways does not believe it is subject to any significant concentration of

credit risk.

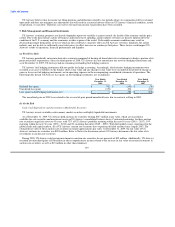

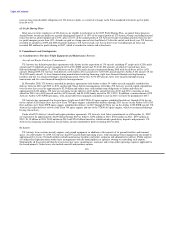

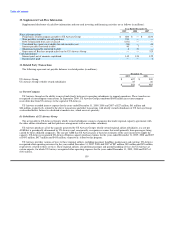

(c) Interest Rate Risk

US Airways has exposure to market risk associated with changes in interest rates related primarily to its variable rate debt obligations.

Interest rates on $1.96 billion principal amount of long-term debt as of December 31, 2009 are subject to adjustment to reflect changes in

floating interest rates. The weighted average effective interest rate on US Airways' variable rate debt was 4.59% at December 31, 2009.

The fair value of US Airways' long-term debt was approximately $2.83 billion and $2.28 billion at December 31, 2009 and 2008,

respectively. The fair values were estimated using quoted market prices where available. For long-term debt not actively traded, fair

values were estimated using a discounted cash flow analysis, based on US Airways' current incremental borrowing rates for similar types

of borrowing arrangements.

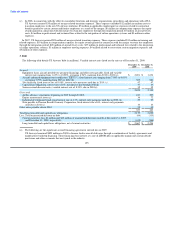

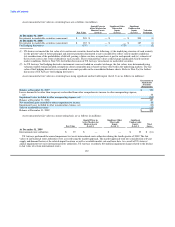

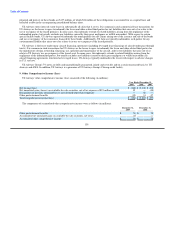

6. Fair Value Measurements

On January 1, 2008, US Airways adopted the provisions of SFAS No. 157, "Fair Value Measurements" (included in FASB ASC Topic

320, Investments-Debt and Equity Securities), which defines fair value, establishes a consistent framework for measuring fair value and

expands disclosure for each major asset and liability category measured at fair value on either a recurring or nonrecurring basis. This

accounting guidance clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should

be determined based on assumptions that market participants would use in pricing an asset or liability. As a basis for considering such

assumptions, this accounting guidance establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair

value as follows:

Level 1. Observable inputs such as quoted prices in active markets;

Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own

assumptions.

131