US Airways 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

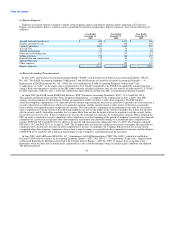

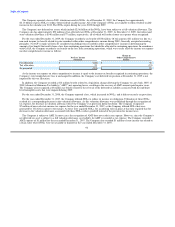

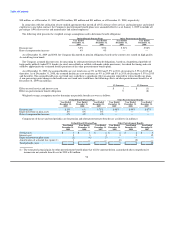

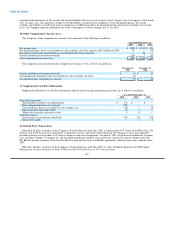

The components of the provision (benefit) for income taxes are as follows (in millions):

Year Ended December 31,

2009 2008 2007

Current provision:

Federal $ — $ 1 $ 1

State — — 1

Total current — 1 2

Deferred provision:

Federal (38) — (1)

State — (1) 6

Total deferred (38) (1) 5

Provision (benefit) for income taxes $ (38) $ — $ 7

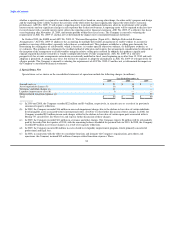

Income tax expense (benefit) differs from amounts computed at the federal statutory income tax rate as follows (in millions):

Year Ended December 31,

2009 2008 2007

Income tax expense (benefit) at the federal statutory income tax rate $ (85) $ (775) $ 151

Book expenses not deductible for tax purposes 17 229 13

State income tax expense, net of federal income tax expense (benefit) (6) (30) 30

Change in valuation allowance 74 575 (185)

AMT provision (benefit) (14) 1 1

Allocation to other comprehensive income (21) — —

Long-lived intangibles (3) — —

Other, net — — (3)

Total $ (38) $ — $ 7

Effective tax rate (15.7)% —% 1.5%

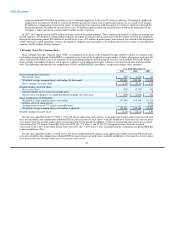

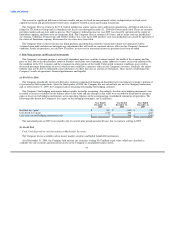

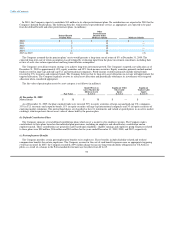

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and liabilities as of

December 31, 2009 and 2008 are as follows (in millions):

2009 2008

Deferred tax assets:

Net operating loss carryforwards $ 779 $ 546

Property, plant and equipment 30 22

Investments 63 95

Financing transactions 41 25

Employee benefits 346 352

Dividend Miles awards 126 144

AMT credit carryforward 25 38

Other deferred tax assets 26 199

Valuation allowance (623) (646)

Net deferred tax assets 813 775

Deferred tax liabilities:

Depreciation and amortization 582 563

Sale and leaseback transactions and deferred rent 137 144

Leasing transactions 45 47

Long-lived intangibles 25 31

Other deferred tax liabilities 40 9

Total deferred tax liabilities 829 794

Net deferred tax liabilities 16 19

Less: current deferred tax liabilities — —

Non-current deferred tax liabilities $ 16 $ 19

93