US Airways 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

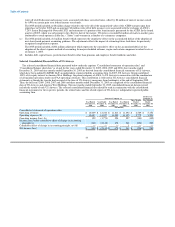

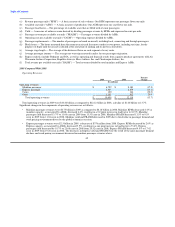

Successor Company (a)

December 31,

2009 2008 2007 2006 2005

(In millions)

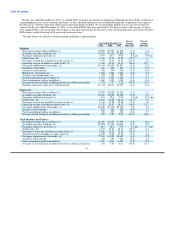

Consolidated balance sheet data (at end of period):

Total assets $ 7,123 $ 6,954 $ 7,787 $ 7,351 $ 6,763

Long-term obligations, less current maturities (e) 3,266 2,867 2,013 2,131 3,238

Total stockholder's equity (deficit) 255 (221) 1,850 (461) (810)

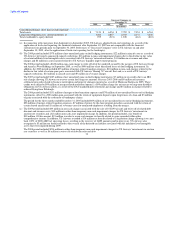

(a) In connection with emergence from bankruptcy in September 2005, US Airways adopted fresh-start reporting. As a result of the

application of fresh-start reporting, the financial statements after September 30, 2005 are not comparable with the financial

statements from periods prior to September 30, 2005. References to "Successor Company" refer to US Airways on and after

September 30, 2005, after the application of fresh-start reporting for the bankruptcy.

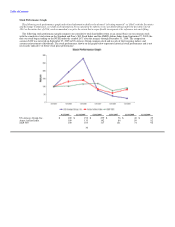

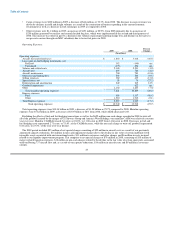

(b) The 2009 period included $375 million of net unrealized gains on fuel hedging instruments, $22 million in aircraft costs as a result of

US Airways' previously announced capacity reductions, $16 million in non-cash impairment charges due to the decline in fair value

of certain indefinite lived intangible assets associated with US Airways' international routes, $11 million in severance and other

charges and $6 million in costs incurred related to US Airways' liquidity improvement program.

The 2008 period included a $622 million non-cash charge to write off all of the goodwill created by the merger of US Airways Group

and America West Holdings in September 2005, as well as $496 million of net unrealized losses on fuel hedging instruments. In

addition, the 2008 period included $35 million of merger-related transition expenses, $18 million in non-cash charges related to the

decline in fair value of certain spare parts associated with US Airways' Boeing 737 aircraft fleet and, as a result of US Airways'

capacity reductions, $14 million in aircraft costs and $9 million in severance charges.

The 2007 period included $187 million of net unrealized gains on fuel hedging instruments, $7 million in tax credits due to an IRS

rule change allowing US Airways to recover certain fuel usage tax amounts for years 2003-2006 and $9 million of insurance

settlement proceeds related to business interruption and property damages incurred as a result of Hurricane Katrina in 2005. These

credits were offset by $99 million of merger-related transition expenses, a $99 million charge for an increase to long-term disability

obligations for US Airways' pilots as a result of the FAA-mandated pilot retirement age change and $4 million in charges related to

reduced flying from Pittsburgh.

The 2006 period included $131 million of merger-related transition expenses and $70 million of net unrealized losses on fuel hedging

instruments, offset by a $90 million gain associated with the return of equipment deposits upon forgiveness of a loan and $3 million

of gains associated with the settlement of bankruptcy claims.

The period for the three months ended December 31, 2005 included $69 million of net unrealized losses on fuel hedging instruments,

$28 million of merger-related transition expenses, $7 million of power-by-the-hour program penalties associated with the return of

certain leased aircraft and $1 million of severance costs for terminated employees resulting from the merger.

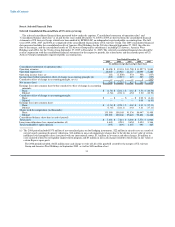

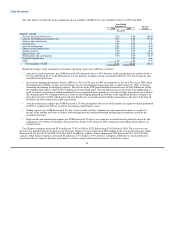

(c) The 2009 period included $49 million in non-cash charges associated with the sale of 10 E190 aircraft and write off of related debt

discount and issuance costs, $10 million in other-than-temporary non-cash impairment charges for US Airways' investments in

auction rate securities and a $2 million non-cash asset impairment charge. In addition, the period included a tax benefit of

$38 million. Of this amount, $21 million was due to a non-cash income tax benefit related to gains recorded within other

comprehensive income. In addition, US Airways recorded a $14 million tax benefit related to a legislation change allowing it to carry

back 100% of 2008 AMT net operating losses, resulting in the recovery of AMT amounts paid in prior years. US Airways also

recognized a $3 million tax benefit related to the reversal of the deferred tax liability associated with the indefinite lived intangible

assets that were impaired during 2009.

The 2008 period included $214 million in other-than-temporary non-cash impairment charges for US Airways' investments in auction

rate securities as well as $6 million in write offs of debt discount and debt

34