US Airways 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

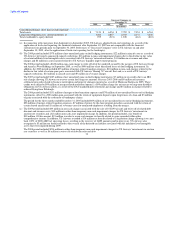

write off of debt discount and issuance costs associated with those converted notes, offset by $8 million of interest income earned

by AWA on certain prior year federal income tax refunds.

The 2005 period included an $8 million charge related to the write off of the unamortized value of the ATSB warrants upon their

repurchase in October 2005 and an aggregate $2 million write off of debt issuance costs associated with the exchange of AWA's

7.25% Senior Exchangeable Notes due 2023 and retirement of a portion of the loan formerly guaranteed by the ATSB. In the fourth

quarter of 2005, which was subsequent to the effective date of the merger, US Airways recorded $4 million of mark-to-market gains

attributable to stock options in Sabre Inc. ("Sabre") and warrants in a number of e-commerce companies.

(c) The 2006 period included a $1 million benefit which represents the cumulative effect on the accumulated deficit of the adoption of

new share-based payment accounting guidance. The adjustment reflects the impact of estimating future forfeitures for previously

recognized compensation expense.

The 2005 period included a $202 million adjustment which represents the cumulative effect on the accumulated deficit of the

adoption of the direct expense method of accounting for major scheduled airframe, engine and certain component overhaul costs as

of January 1, 2005.

(d) Includes debt, capital leases, postretirement benefits other than pensions and employee benefit liabilities and other.

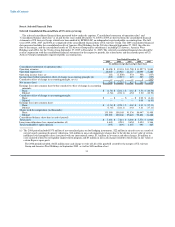

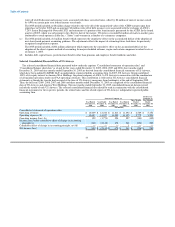

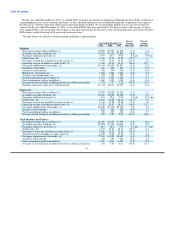

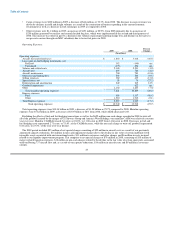

Selected Consolidated Financial Data of US Airways

The selected consolidated financial data presented below under the captions "Consolidated statements of operations data" and

"Consolidated balance sheet data" as of and for the years ended December 31, 2009, 2008, 2007 and 2006, three months ended

December 31, 2005 and nine months ended September 30, 2005 are derived from the consolidated financial statements of US Airways,

which have been audited by KPMG LLP, an independent registered public accounting firm. In 2007, US Airways Group contributed

100% of its equity interest in America West Holdings, the parent company of AWA, to US Airways in connection with the combination

of all mainline operations under one FAA operating certificate. This contribution is reflected in US Airways' consolidated financial

statements as though the transfer had occurred at the time of US Airways' emergence from bankruptcy at the end of September 2005.

Thus, the full years 2009, 2008, 2007 and 2006 and three months ended December 31, 2005 are comprised of the consolidated financial

data of US Airways and America West Holdings. The nine months ended September 30, 2005 consolidated financial data presented

include the results of only US Airways. The selected consolidated financial data should be read in conjunction with the consolidated

financial statements for the respective periods, the related notes and the related reports of US Airways' independent registered public

accounting firm.

Predecessor

Successor Company (a) Company (a)

Three Months Nine Months

Year Ended Year Ended Year Ended Year Ended Ended Ended

December 31, December 31, December 31, December 31, December 31, September 30,

2009 2008 2007 2006 2005 2005

(In millions)

Consolidated statements of operations data:

Operating revenues $ 10,609 $ 12,244 $ 11,813 $ 11,692 $ 2,589 $ 5,452

Operating expenses (b) 10,487 14,017 11,289 11,135 2,772 5,594

Operating income (loss) (b) 122 (1,773) 524 557 (183) (142)

Income (loss) before cumulative effect of change in accounting

principle (c) (140) (2,148) 478 348 (256) 280

Cumulative effect of change in accounting principle, net (d) — — — 1 — —

Net income (loss) $ (140) $ (2,148) $ 478 $ 349 $ (256) $ 280

33