US Airways 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

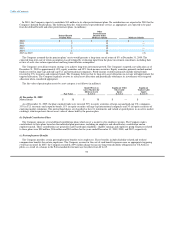

As of December 31, 2009, there were $3 million of total unrecognized compensation costs related to RSUs. These costs are expected

to be recognized over a weighted average period of 0.9 years. The total fair value of RSUs vested during 2009, 2008 and 2007 was

$2 million, $3 million and $14 million, respectively.

Stock Options and Stock Appreciation Rights — Stock options and stock appreciation rights are granted with an exercise price equal to

the underlying common stock's fair market value at the date of each grant. Stock options and stock appreciation rights have service

conditions, become exercisable over a three-year vesting period and expire if unexercised at the end of their term, which ranges from

seven to 10 years. Stock options and stock-settled stock appreciation rights ("SARs") are classified as equity awards as the exercise

results in the issuance of shares of the Company's common stock. Cash-settled stock appreciation rights ("CSARs") are classified as

liability awards as the exercise results in payment of cash by the Company.

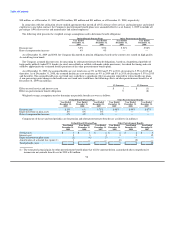

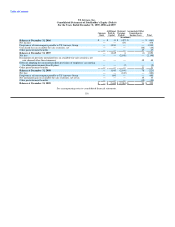

Stock option and SARs activity for the years ending December 31, 2009, 2008 and 2007 is as follows (stock options and SARs in

thousands):

Weighted

Average

Stock Weighted Remaining

Options Average Contractual Term Aggregate

and SARs Exercise Price (years) Intrinsic Value

(In millions)

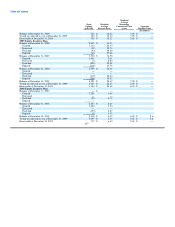

1994 Incentive Equity Plan

Balance at December 31, 2006 750 $ 46.10

Granted — —

Exercised (30) 40.93

Forfeited — —

Expired (75) 46.38

Balance at December 31, 2007 645 $ 46.30

Granted — —

Exercised (2) 9.21

Forfeited — —

Expired (244) 55.35

Balance at December 31, 2008 399 $ 40.96

Granted — —

Exercised — —

Forfeited — —

Expired (200) 45.34

Balance at December 31, 2009 199 $ 36.57 .62 $ —

Vested or expected to vest at December 31, 2009 199 $ 36.57 .62 $ —

Exercisable at December 31, 2009 199 $ 36.57 .62 $ —

2002 Incentive Equity Plan

Balance at December 31, 2006 798 $ 18.33

Granted — —

Exercised (36) 14.36

Forfeited — —

Expired — —

Balance at December 31, 2007 762 $ 18.52

Granted — —

Exercised (2) 6.42

Forfeited — —

Expired (23) 25.08

Balance at December 31, 2008 737 $ 18.34

Granted — —

Exercised — —

Forfeited — —

Expired (17) 19.39

106