US Airways 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

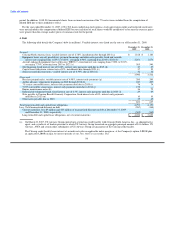

The Company reported a loss in 2009, which increased its NOLs. As of December 31, 2009, the Company has approximately

$2.13 billion of gross NOLs to reduce future federal taxable income. All of the Company's NOLs are available to reduce federal taxable

income in the calendar year 2010. The NOLs expire during the years 2022 through 2029.

The Company's net deferred tax assets, which include $2.06 billion of the NOLs, have been subject to a full valuation allowance. The

Company also has approximately $90 million of tax-effected state NOLs at December 31, 2009. At December 31, 2009, the federal and

state valuation allowance is $546 million and $77 million, respectively, all of which will reduce future tax expense when recognized.

For the year ended December 31, 2009, the Company recorded a tax benefit of $38 million. Of this amount, $21 million was due to a

non-cash income tax benefit related to gains recorded within other comprehensive income during 2009. Generally accepted accounting

principles ("GAAP") require all items be considered (including items recorded in other comprehensive income) in determining the

amount of tax benefit that results from a loss from continuing operations that should be allocated to continuing operations. In accordance

with GAAP, the Company recorded a tax benefit on the loss from continuing operations, which was exactly offset by income tax expense

on other comprehensive income as follows:

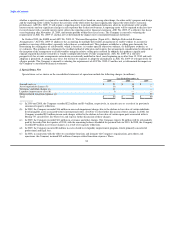

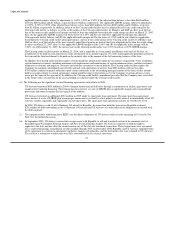

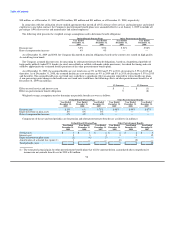

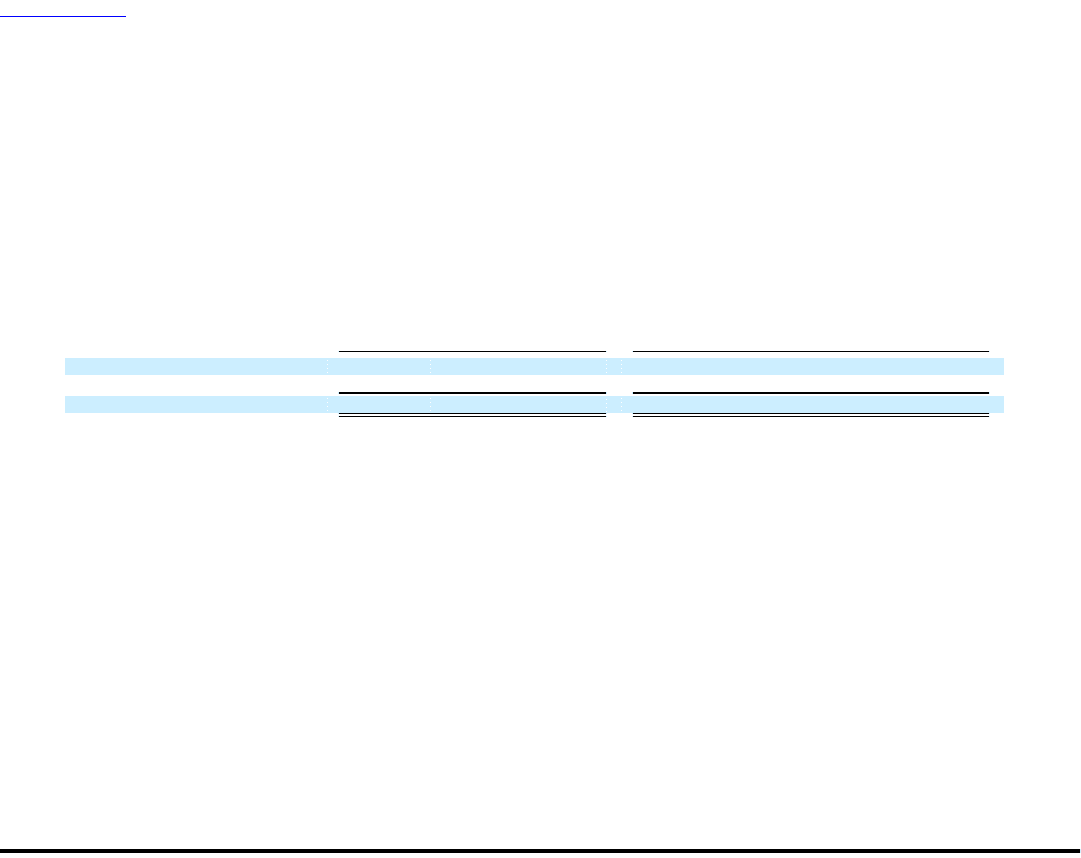

Change in

Net Loss Income Other Comprehensive

Statement Income

Pre-allocation $ (226) $ 46

Tax allocation 21 (21)

As presented $ (205) $ 25

As the income tax expense on other comprehensive income is equal to the income tax benefit recognized in continuing operations, the

Company's total comprehensive loss is unchanged. In addition, the Company's net deferred tax position at December 31, 2009 is not

impacted by this tax allocation.

In addition, the Company recorded a $14 million benefit related to a legislation change allowing the Company to carry back 100% of

2008 Alternative Minimum Tax liability ("AMT") net operating losses, resulting in the recovery of AMT amounts paid in prior years.

The Company also recognized a $3 million tax benefit related to the reversal of the deferred tax liability associated with the indefinite

lived intangible assets that were impaired during 2009.

For the year ended December 31, 2008, the Company reported a loss, which increased its NOLs, and it did not record a tax provision.

For the year ended December 31, 2007, the Company utilized NOLs to reduce its income tax obligation. Utilization of these NOLs

resulted in a corresponding decrease in the valuation allowance. As this valuation allowance was established through the recognition of

tax expense, the decrease in valuation allowance offset the Company's tax provision dollar for dollar. The Company recognized

$7 million of non-cash state income tax expense for the year ended December 31, 2007, as the Company utilized NOLs that were

generated by US Airways prior to the merger. As these were acquired NOLs, the accounting rules in place at that time required that the

decrease in the valuation allowance associated with these NOLs reduce goodwill instead of the provision for income taxes.

The Company is subject to AMT. In most cases, the recognition of AMT does not result in tax expense. However, since the Company's

net deferred tax asset is subject to a full valuation allowance, any liability for AMT is recorded as tax expense. The Company recorded

AMT expense of $1 million for the year ended December 31, 2007. The Company also recorded $1 million of state income tax related to

certain states where NOLs were not available or limited for the year ended December 31, 2007.

92