US Airways 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

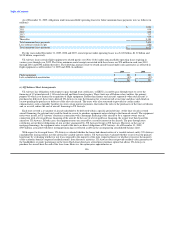

principal and interest on these bonds are $137 million, of which $34 million of these obligations is accounted for as a capital lease and

reflected as debt in the accompanying consolidated balance sheet.

US Airways enters into real estate leases in substantially all cities that it serves. It is common in such commercial lease transactions for

US Airways as the lessee to agree to indemnify the lessor and other related third parties for tort liabilities that arise out of or relate to the

use or occupancy of the leased premises. In some cases, this indemnity extends to related liabilities arising from the negligence of the

indemnified parties, but usually excludes any liabilities caused by their gross negligence or willful misconduct. With respect to certain

special facility bonds, US Airways agreed to indemnify the municipalities for any claims arising out of the issuance and sale of the bonds

and use or occupancy of the concourses financed by these bonds. Additionally, US Airways typically indemnifies such parties for any

environmental liability that arises out of or relates to its use or occupancy of the leased premises.

US Airways is the lessee under many aircraft financing agreements (including leveraged lease financings of aircraft under pass through

trusts). It is common in such transactions for US Airways as the lessee to agree to indemnify the lessor and other related third parties for

the manufacture, design, ownership, financing, use, operation and maintenance of the aircraft, and for tort liabilities that arise out of or

relate to US Airways' use or occupancy of the leased asset. In some cases, this indemnity extends to related liabilities arising from the

negligence of the indemnified parties, but usually excludes any liabilities caused by their gross negligence or willful misconduct. In

aircraft financing agreements structured as leveraged leases, US Airways typically indemnifies the lessor with respect to adverse changes

in U.S. tax laws.

US Airways Group's 7% notes are fully and unconditionally guaranteed, jointly and severally and on a senior unsecured basis, by US

Airways and AWA. In addition, US Airways is a guarantor of US Airways Group's Citicorp credit facility.

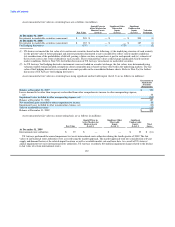

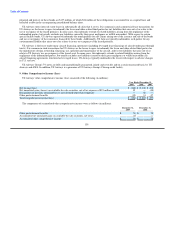

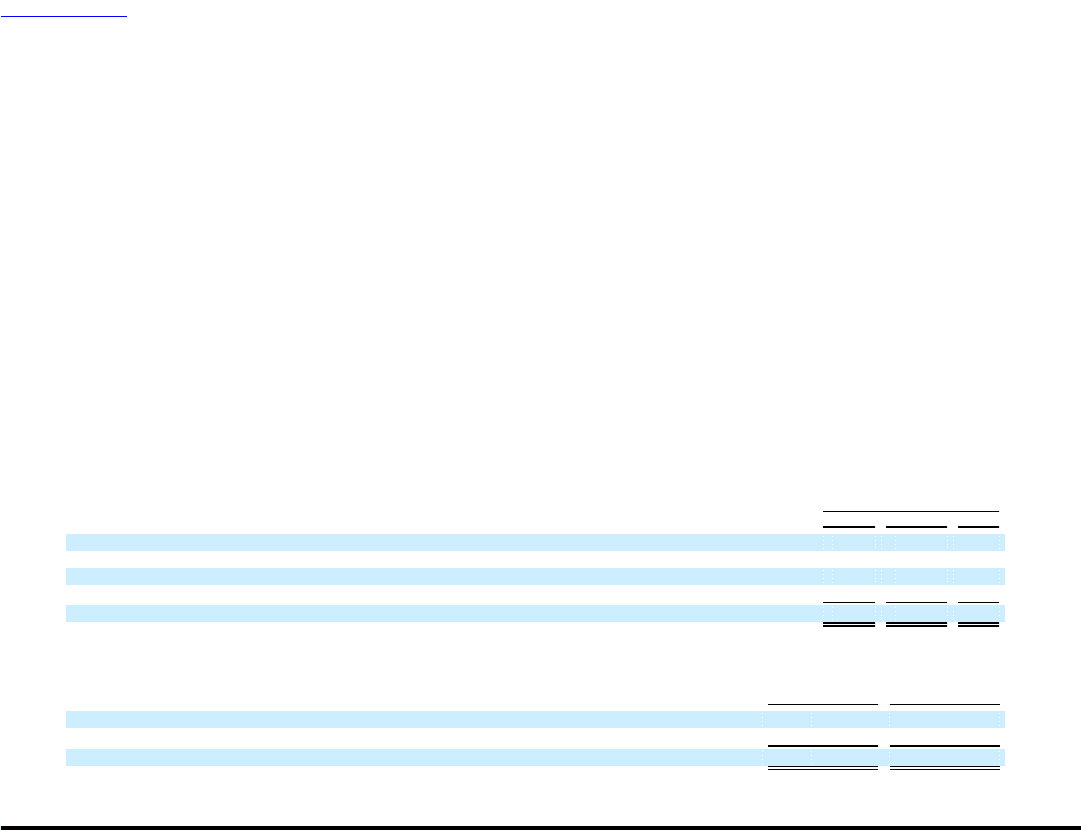

9. Other Comprehensive Income (Loss)

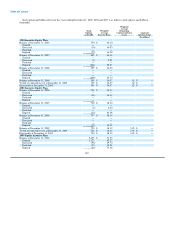

US Airways' other comprehensive income (loss) consisted of the following (in millions):

Year Ended December 31,

2009 2008 2007

Net income (loss) $ (140) $ (2,148) $ 478

Net unrealized gains (losses) on available-for-sale securities, net of tax expense of $21 million in 2009 35 — (48)

Recognition of previous unrealized losses now deemed other-than-temporary — 48 —

Other postretirement benefits (19) 31 47

Total comprehensive income (loss) $ (124) $ (2,069) $ 477

The components of accumulated other comprehensive income were as follows (in millions):

December 31, December 31,

2009 2008

Other postretirement benefits $ 59 $ 78

Accumulated net unrealized gains on available-for-sale securities, net of tax 35 —

Accumulated other comprehensive income $ 94 $ 78

138