US Airways 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

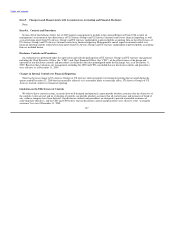

Table of Contents

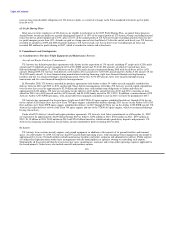

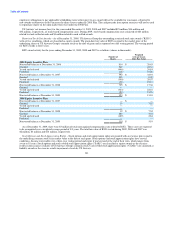

Weighted

Average

Stock Weighted Remaining

Options Average Contractual Term Aggregate

and SARs Exercise Price (years) Intrinsic Value

(In millions)

Balance at December 31, 2007 3,370 $ 34.96

Granted 1,959 9.11

Exercised (5) 8.84

Forfeited (200) 30.18

Expired (218) 32.76

Balance at December 31, 2008 4,906 $ 24.93

Granted — —

Exercised — —

Forfeited (119) 20.43

Expired (266) 30.82

Balance at December 31, 2009 4,521 $ 24.67 7.00 $ —

Vested or expected to vest at December 31, 2009 4,429 $ 24.87 6.98 $ —

Exercisable at December 31, 2009 3,184 $ 28.69 6.54 $ —

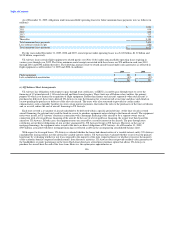

2008 Equity Incentive Plan

Balance at December 31, 2007 — $ —

Granted 2,389 6.64

Exercised — —

Forfeited (56) 6.70

Expired — —

Balance at December 31, 2008 2,333 $ 6.64

Granted 3,286 3.23

Exercised — —

Forfeited (193) 6.67

Expired (8) 6.70

Balance at December 31, 2009 5,418 $ 4.57 6.03 $ 5.6

Vested or expected to vest at December 31, 2009 5,095 $ 4.59 6.02 $ 5.2

Exercisable at December 31, 2009 717 $ 6.65 5.63 $ —

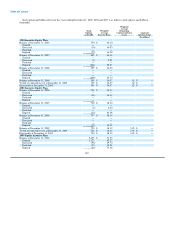

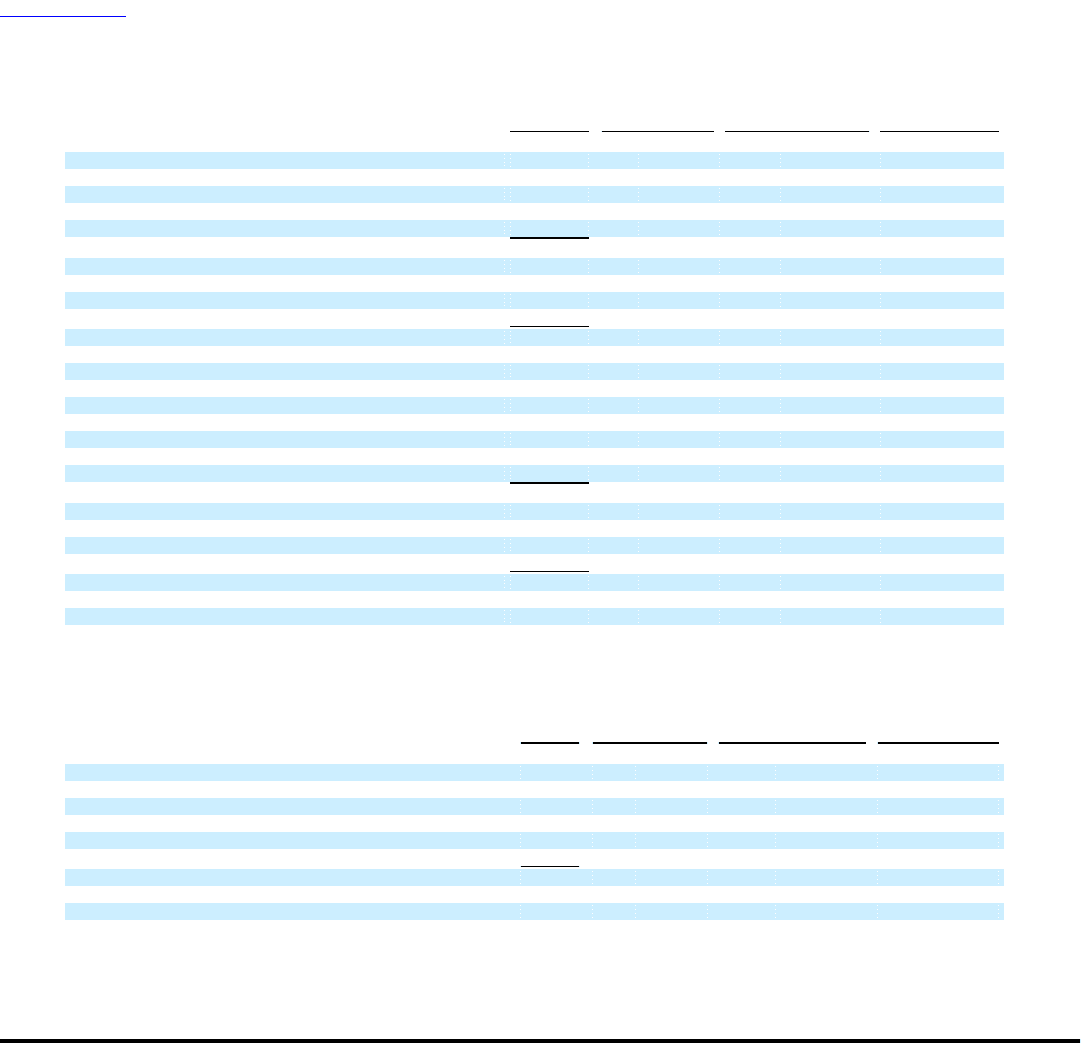

CSARs activity for the year ending December 31, 2009 is as follows (CSARs in thousands):

Weighted

Average

Weighted Remaining

Average Contractual Term Aggregate

CSARs Exercise Price (years) Intrinsic Value

(In millions)

2008 Equity Incentive Plan

Balance at December 31, 2008 — $ —

Granted 4,645 3.10

Exercised — —

Forfeited (232) 3.10

Expired — —

Balance at December 31, 2009 4,413 $ 3.10 6.27 $ 7.7

Vested or expected to vest at December 31, 2009 4,110 $ 3.10 6.27 $ 7.2

Exercisable at December 31, 2009 3 $ 5.23 5.87 $ —

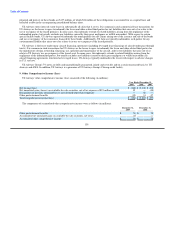

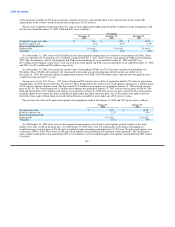

The fair value of stock options and stock appreciation rights is determined at the grant date using a Black-Scholes option pricing

model, which requires several assumptions. The risk-free interest rate is based on the U.S. Treasury yield curve in effect for the expected

term of the award at the time of grant. The dividend yield is assumed to be zero as US Airways Group does not pay dividends and has no

current plans to do so in the future. The volatility is based 143