US Airways 2009 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

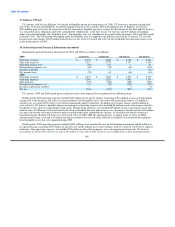

estimate of the aircraft's fair value at the option date. Under this feature, US Airways does not participate in any increases in the value of

the aircraft. US Airways concluded it was not the primary beneficiary under these arrangements. Therefore, US Airways accounts for its

EETC leveraged lease financings as operating leases. US Airways' total future obligations under these leveraged lease financings are

$3.25 billion as of December 31, 2009, which are included in the future minimum lease payments table in (b) above.

(d) Regional Jet Capacity Purchase Agreements

US Airways has entered into capacity purchase agreements with certain regional jet operators. The capacity purchase agreements

provide that all revenues, including passenger, mail and freight revenues, go to US Airways. In return, US Airways agrees to pay

predetermined fees to these airlines for operating an agreed-upon number of aircraft, without regard to the number of passengers onboard.

In addition, these agreements provide that certain variable costs, such as airport landing fees and passenger liability insurance, will be

reimbursed 100% by US Airways. US Airways controls marketing, scheduling, ticketing, pricing and seat inventories. The regional jet

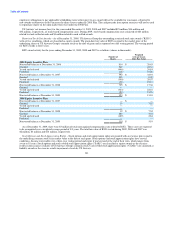

capacity purchase agreements have expirations from 2012 to 2020. The future minimum noncancellable commitments under the regional

jet capacity purchase agreements are $1.01 billion in 2010, $1.03 billion in 2011, $900 million in 2012, $772 million in 2013,

$771 million in 2014 and $2.35 billion thereafter.

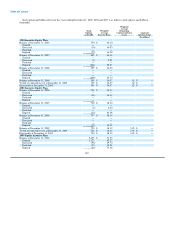

Certain entities with which US Airways has capacity purchase agreements are considered variable interest entities. In connection with

its restructuring and emergence from bankruptcy, US Airways contracted with Air Wisconsin and Republic to purchase a significant

portion of these companies' regional jet capacity for a period of 10 years. US Airways has determined that it is not the primary

beneficiary of these variable interest entities, based on cash flow analyses. Additionally, US Airways has analyzed the arrangements with

other carriers with which US Airways has long-term capacity purchase agreements and has concluded it is not required to consolidate any

of the entities.

(e) Legal Proceedings

On September 12, 2004, US Airways Group and its domestic subsidiaries (collectively, the "Reorganized Debtors") filed voluntary

petitions for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Eastern District of Virginia,

Alexandria Division (Case Nos. 04-13819-SSM through 03-13823-SSM) (the "2004 Bankruptcy"). On September 16, 2005, the

Bankruptcy Court issued an order confirming the plan of reorganization submitted by the Reorganized Debtors and on September 27,

2005, the Reorganized Debtors emerged from the 2004 Bankruptcy. The Bankruptcy Court's order confirming the plan included a

provision called the plan injunction, which forever bars other parties from pursuing most claims against the Reorganized Debtors that

arose prior to September 27, 2005 in any forum other than the Bankruptcy Court. Substantially all of the claims in the 2004 Bankruptcy

have been settled and the remaining claims, if paid at all, will be paid out in common stock of the post-bankruptcy US Airways Group at

a small fraction of the actual claim amount. However, the effects of these common stock distributions were already reflected in US

Airways' financial statements upon emergence from bankruptcy and will not have any further impact on its financial position or results of

operations. US Airways presently expects the bankruptcy case to be closed during 2010.

US Airways and/or its subsidiaries are defendants in various pending lawsuits and proceedings, and from time to time are subject to

other claims arising in the normal course of its business, many of which are covered in whole or in part by insurance. The outcome of

those matters cannot be predicted with certainty at this time, but US Airways, having consulted with outside counsel, believes that the

ultimate disposition of these contingencies will not materially affect its consolidated financial position or results of operations.

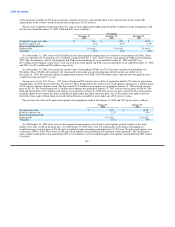

(f) Guarantees and Indemnifications

US Airways guarantees the payment of principal and interest on certain special facility revenue bonds issued by municipalities to build

or improve certain airport and maintenance facilities which are leased to US Airways. Under such leases, US Airways is required to make

rental payments through 2023, sufficient to pay maturing principal and interest payments on the related bonds. As of December 31, 2009,

the remaining lease payments guaranteeing the

137