US Airways 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

"Consolidations (Topic 810) — Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities." ASU

No. 2009-17 changes how a reporting entity determines when an entity that is insufficiently capitalized or is not controlled through voting

(or similar rights) should be consolidated. The determination of whether a reporting entity is required to consolidate another entity is

based on, among other things, the other entity's purpose and design and the reporting entity's ability to direct the activities of the other

entity that most significantly impact the other entity's economic performance. ASU No. 2009-17 will require a reporting entity to provide

additional disclosures about its involvement with variable interest entities and any significant changes in risk exposure due to that

involvement. A reporting entity will be required to disclose how its involvement with a variable interest entity affects the reporting

entity's financial statements. ASU No. 2009-17 is effective for fiscal years beginning after November 15, 2009, and interim periods

within those fiscal years. US Airways is currently evaluating the requirements of ASU No. 2009-17 and has not yet determined the

impact on its consolidated financial statements.

In October 2009, the FASB issued ASU No. 2009-13, "Revenue Recognition (Topic 605) — Multiple-Deliverable Revenue

Arrangements." ASU No. 2009-13 addresses the accounting for multiple-deliverable arrangements to enable vendors to account for

products or services (deliverables) separately rather than as a combined unit. This guidance establishes a selling price hierarchy for

determining the selling price of a deliverable, which is based on: (a) vendor-specific objective evidence; (b) third-party evidence; or

(c) estimates. This guidance also eliminates the residual method of allocation and requires that arrangement consideration be allocated at

the inception of the arrangement to all deliverables using the relative selling price method. In addition, this guidance significantly

expands required disclosures related to a vendor's multiple-deliverable revenue arrangements. ASU No. 2009-13 is effective

prospectively for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010 and early

adoption is permitted. A company may elect, but will not be required, to adopt the amendments in ASU No. 2009-13 retrospectively for

all prior periods. US Airways is currently evaluating the requirements of ASU No. 2009-13 and has not yet determined the impact on its

consolidated financial statements.

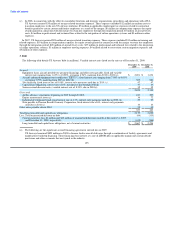

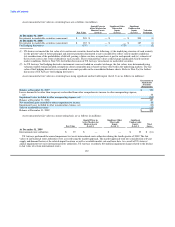

2. Special Items, Net

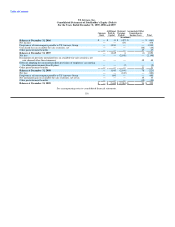

Special items, net as shown on the consolidated statements of operations include the following charges (in millions):

Year Ended December 31,

2009 2008 2007

Aircraft costs (a) $ 22 $ 14 $ —

Asset impairment charges (b) 16 18 —

Severance and other charges (c) 11 9 —

Liquidity improvement costs (d) 6 — —

Merger-related transition expenses (e) — 35 99

Total $ 55 $ 76 $ 99

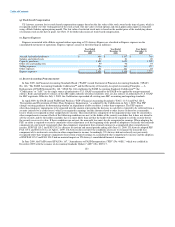

(a) In 2009 and 2008, US Airways recorded $22 million and $14 million, respectively, in aircraft costs as a result of its previously

announced capacity reductions.

(b) In 2009, US Airways recorded $16 million in non-cash impairment charges due to the decline in fair value of certain indefinite lived

intangible assets associated with its international routes. See Note 1(i) for further discussion of these charges. In 2008, US Airways

recorded $18 million in non-cash charges related to the decline in fair value of certain spare parts associated with its Boeing 737

aircraft fleet. See Notes 1(f) and 1(g) for further discussion of these charges.

(c) In 2009, US Airways recorded $11 million in severance and other charges. US Airways expects $4 million will be substantially paid

by the end of the first quarter of 2010, with the remaining balance scheduled for payment later in 2010. In 2008, US Airways

recorded $9 million in severance charges as a result of its capacity reductions.

(d) In 2009, US Airways incurred $6 million in costs related to its liquidity improvement program, which primarily consisted of

professional and legal fees.

124