US Airways 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

aircraft capital expenditures over the next three years by approximately $2.5 billion and reduce near- and medium-term obligations to

Airbus and others by approximately $132 million. US Airways now plans to take delivery of 28 Airbus aircraft between 2010 and 2012,

consisting of four aircraft in 2010 (two A320 aircraft and two A330 aircraft) and 24 A320 family aircraft in 2011-2012. In addition,

commencement of US Airways' Airbus A350 XWB operations, with aircraft deliveries originally scheduled to start in 2015, will now be

postponed to 2017.

US Airways has agreements for the purchase of eight new IAE V2500-A5 spare engines scheduled for delivery through 2014 for use

on the Airbus A320 family fleet, three new Trent 700 spare engines scheduled for delivery through 2013 for use on the Airbus A330-200

fleet and three new Trent XWB spare engines scheduled for delivery in 2017 through 2019 for use on the Airbus A350 XWB aircraft. US

Airways has taken delivery of two of the Trent 700 spare engines and one of the V2500-A5 spare engines, which were financed through

leasing transactions.

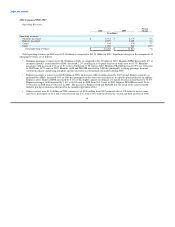

Under all of our aircraft and engine purchase agreements, our total future commitments as of December 31, 2009 are expected to be

approximately $6.09 billion through 2019 as follows: $296 million in 2010, $504 million in 2011, $579 million in 2012, $1.15 billion in

2013, $932 million in 2014 and $2.63 billion thereafter, which includes predelivery deposits and payments. We have financing

commitments for all Airbus aircraft scheduled for delivery during 2010 to 2012. See Part I, Item 1A, "Risk Factors — Increased costs of

financing, a reduction in the availability of financing and fluctuations in interest rates could adversely affect our liquidity, operating

expenses and results" and "Our high level of fixed obligations limits our ability to fund general corporate requirements and obtain

additional financing, limits our flexibility in responding to competitive developments and increases our vulnerability to adverse economic

and industry conditions."

Covenants and Credit Rating

In addition to the minimum cash balance requirements, our long-term debt agreements contain various negative covenants that restrict

or limit our actions, including our ability to pay dividends or make other restricted payments. Our long-term debt agreements also

generally contain cross-default provisions, which may be triggered by defaults by us under other agreements relating to indebtedness. See

Part I, Item 1A, "Risk Factors — Our high level of fixed obligations limits our ability to fund general corporate requirements and obtain

additional financing, limits our flexibility in responding to competitive developments and increases our vulnerability to adverse economic

and industry conditions" and "Any failure to comply with the liquidity covenants contained in our financing arrangements would likely

have a material adverse effect on our business, financial condition and results of operations." As of December 31, 2009, we and our

subsidiaries were in compliance with the covenants in our long-term debt agreements.

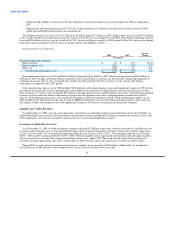

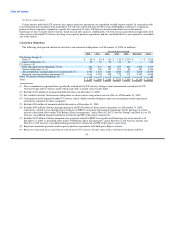

Our credit ratings, like those of most airlines, are relatively low. The following table details our credit ratings as of December 31,

2009:

S&P Fitch Moody's

Local Issuer Issuer Default Corporate

Credit Rating Credit Rating Family Rating

US Airways Group B- CCC Caa1

US Airways B- * *

(*) The credit agencies do not rate these categories for US Airways.

A decrease in our credit ratings could cause our borrowing costs to increase, which would increase our interest expense and could

affect our net income, and our credit ratings could adversely affect our ability to obtain additional financing. If our financial performance

or industry conditions do not improve, we may face future downgrades, which could further negatively impact our borrowing costs and

the prices of our equity or debt securities. In addition, any downgrade of our credit ratings may indicate a decline in our business and in

our ability to satisfy our obligations under our indebtedness.

Off-Balance Sheet Arrangements

An off-balance sheet arrangement is any transaction, agreement or other contractual arrangement involving an unconsolidated entity

under which a company has (1) made guarantees, (2) a retained or a contingent interest in

63