US Airways 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

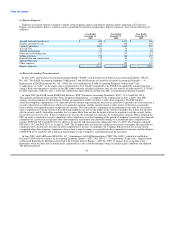

period. In addition, 3,048,914 incremental shares from assumed conversion of the 7% notes were excluded from the computation of

diluted EPS due to their antidilutive effect.

For the year ended December 31, 2007, 2,916,762 shares underlying stock options, stock appreciation rights and restricted stock units

were not included in the computation of diluted EPS because inclusion of such shares would be antidilutive or because the exercise prices

were greater than the average market price of common stock for the period.

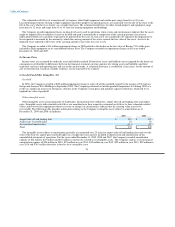

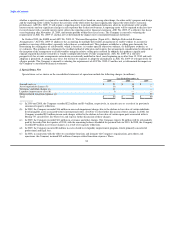

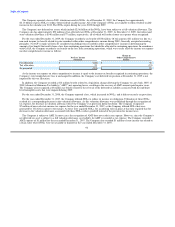

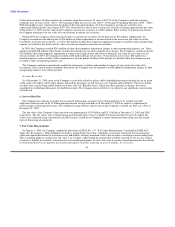

4. Debt

The following table details the Company's debt (in millions). Variable interest rates listed are the rates as of December 31, 2009.

December 31, December 31,

2009 2008

Secured

Citicorp North America loan, variable interest rate of 2.78%, installments due through 2014 (a) $ 1,168 $ 1,184

Equipment loans, aircraft pre-delivery payment financings and other notes payable, fixed and variable

interest rates ranging from 1.63% to 10.28%, averaging 4.94%, maturing from 2010 to 2021 (b) 2,201 1,674

Aircraft enhanced equipment trust certificates ("EETCs"), fixed interest rates ranging from 7.08% to 9.01%,

averaging 7.79%, maturing from 2015 to 2022 (c) 505 540

Slot financing, fixed interest rate of 8.08%, interest only payments until due in 2015 (d) 47 47

Capital lease obligations, interest rate of 8%, installments due through 2021 (e) 37 39

Senior secured discount notes, variable interest rate of 8.39%, due in 2010 (f) 32 32

3,990 3,516

Unsecured

Barclays prepaid miles, variable interest rate of 4.98%, interest only payments (g) 200 200

Airbus advance, repayments beginning in 2010 through 2018 (h) 247 207

7% senior convertible notes, interest only payments until due in 2020 (i) 74 74

7.25% convertible senior notes, interest only payments until due in 2014 (j) 172 —

Engine maintenance notes (k) 36 72

Industrial development bonds, fixed interest rate of 6.3%, interest only payments until due in 2023 (l) 29 29

Note payable to Pension Benefit Guaranty Corporation, fixed interest rate of 6%, interest only payments

until due in 2012 (m) 10 10

Other notes payable, due in 2010 35 45

803 637

Total long-term debt and capital lease obligations 4,793 4,153

Less: Total unamortized discount on debt (267) (168)

Current maturities, less $9 million and $10 million of unamortized discount on debt at December 31, 2009

and December 31, 2008, respectively (502) (362)

Long-term debt and capital lease obligations, net of current maturities $ 4,024 $ 3,623

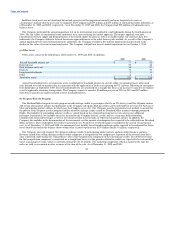

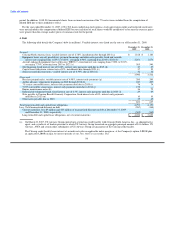

(a) On March 23, 2007, US Airways Group entered into a term loan credit facility with Citicorp North America, Inc., as administrative

agent, and a syndicate of lenders pursuant to which US Airways Group borrowed an aggregate principal amount of $1.6 billion. US

Airways, AWA and certain other subsidiaries of US Airways Group are guarantors of the Citicorp credit facility.

The Citicorp credit facility bears interest at an index rate plus an applicable index margin or, at the Company's option, LIBOR plus

an applicable LIBOR margin for interest periods of one, two, three or six months. The

86