US Airways 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Jet Service Agreements

Certain entities with which US Airways has capacity purchase agreements are considered variable interest entities. In connection with

its restructuring and emergence from bankruptcy, US Airways contracted with Air Wisconsin and Republic to purchase a significant

portion of these companies' regional jet capacity for a period of 10 years. US Airways has determined that it is not the primary

beneficiary of these variable interest entities, based on cash flow analyses. Additionally, US Airways has analyzed the arrangements with

other carriers with which US Airways has long-term capacity purchase agreements and has concluded that it is not required to consolidate

any of the entities.

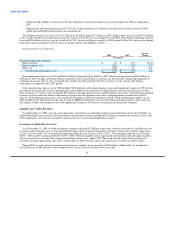

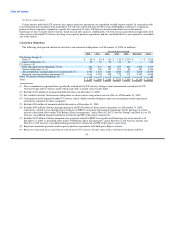

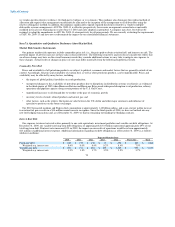

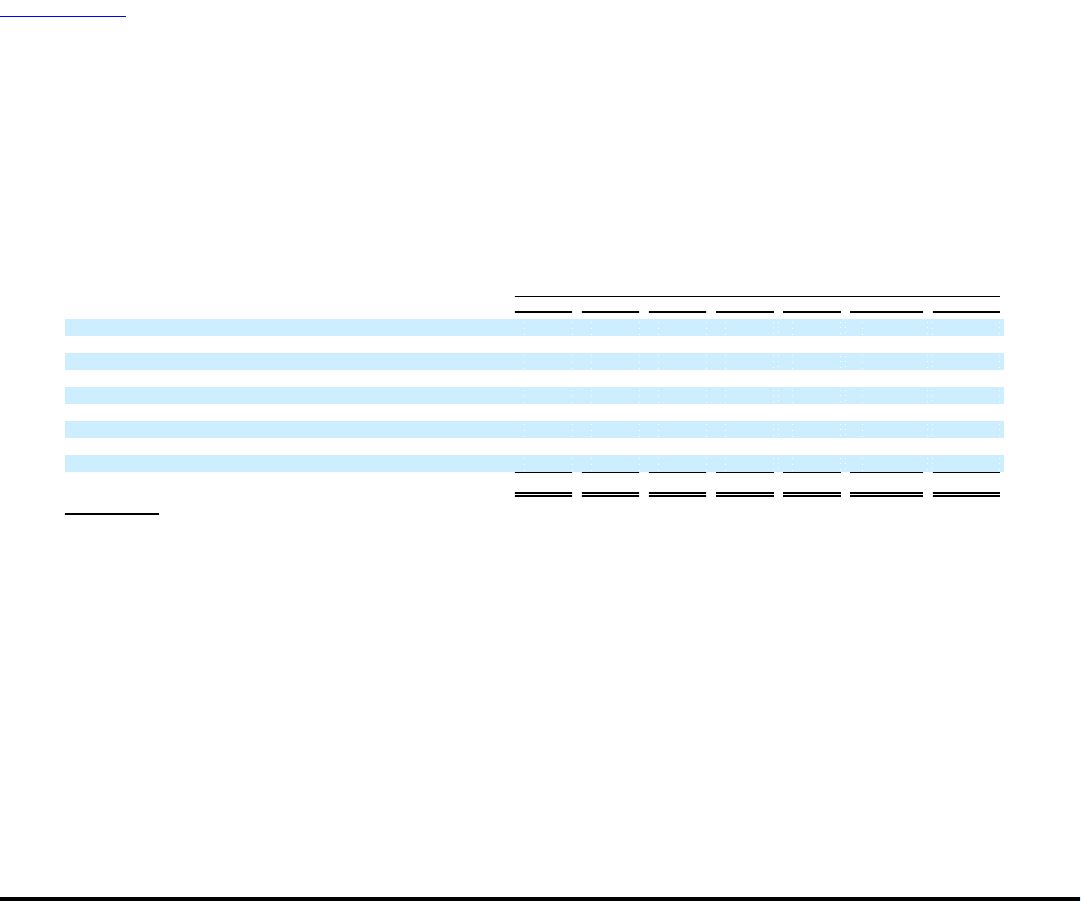

Contractual Obligations

The following table provides details of our future cash contractual obligations as of December 31, 2009 (in millions):

Payments Due by Period

2010 2011 2012 2013 2014 Thereafter Total

US Airways Group (1)

Debt (2) $ 90 $ 16 $ 116 $ 116 $ 1,276 $ — $ 1,614

Interest obligations (3) 57 54 51 46 22 — 230

US Airways (4)

Debt and capital lease obligations (5) (6) 421 334 305 255 265 1,599 3,179

Interest obligations (3) (6) 152 156 147 104 88 387 1,034

Aircraft purchase and operating lease commitments (7) 1,360 1,443 1,441 1,860 1,571 5,815 13,490

Regional capacity purchase agreements (8) 1,013 1,032 900 772 771 2,347 6,835

Other US Airways Group subsidiaries (9) 11 9 9 7 6 1 43

Total $ 3,104 $ 3,044 $ 2,969 $ 3,160 $ 3,999 $ 10,149 $ 26,425

(1) These commitments represent those specifically entered into by US Airways Group or joint commitments entered into by US

Airways Group and US Airways under which each entity is jointly and severally liable.

(2) Excludes $173 million of unamortized debt discount as of December 31, 2009.

(3) For variable-rate debt, future interest obligations are shown above using interest rates in effect as of December 31, 2009.

(4) Commitments listed separately under US Airways and its wholly owned subsidiaries represent commitments under agreements

entered into separately by those companies.

(5) Excludes $94 million of unamortized debt discount as of December 31, 2009.

(6) Includes $505 million of future principal payments and $219 million of future interest payments as of December 31, 2009,

respectively, related to pass through trust certificates or EETCs associated with mortgage financings for the purchase of certain

aircraft as described above under "Off-Balance Sheet Arrangements" and in Note 9(c) to US Airways Group's and Note 8(c) to US

Airways' consolidated financial statements in Item 8A and 8B of this report, respectively.

(7) Includes $3.25 billion of future minimum lease payments related to EETC leveraged leased financings of certain aircraft as of

December 31, 2009, as described above under "Off-Balance Sheet Arrangements" and in Note 9(c) to US Airways Group's and

Note 8(c) to US Airways' consolidated financial statements in Item 8A and 8B of this report, respectively.

(8) Represents minimum payments under capacity purchase agreements with third-party Express carriers.

(9) Represents operating lease commitments entered into by US Airways Group's other airline subsidiaries Piedmont and PSA.

65