US Airways 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

or reliable, which could harm our reputation, result in air travelers being reluctant to fly on our aircraft or those of our regional operators

or codeshare partners and adversely impact our financial condition and operations.

Delays in scheduled aircraft deliveries or other loss of anticipated fleet capacity may adversely impact our operations and financial

results.

The success of our business depends on, among other things, the ability to operate a certain number and type of aircraft. In many cases,

the aircraft we intend to operate are not yet in our fleet, but we have contractual commitments to purchase or lease them. If for any reason

we were unable to accept or secure deliveries of new aircraft on contractually scheduled delivery dates, this could have a negative impact

on our business, operations and financial performance. Our failure to integrate newly purchased aircraft into our fleet as planned might

require us to seek extensions of the terms for some leased aircraft. Such unanticipated extensions may require us to operate existing

aircraft beyond the point at which it is economically optimal to retire them, resulting in increased maintenance costs. If new aircraft

orders are not filled on a timely basis, we could face higher monthly rental rates.

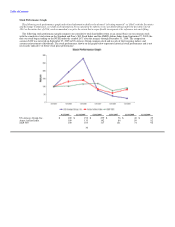

Our business is subject to weather factors and seasonal variations in airline travel, which cause our results to fluctuate.

Our operations are vulnerable to severe weather conditions in parts of our network that could disrupt service, create air traffic control

problems, decrease revenue and increase costs, such as during hurricane season in the Caribbean and Southeast United States, snow and

severe winter weather in the Northeast United States and thunderstorms in the Eastern United States. In addition, the air travel business

historically fluctuates on a seasonal basis. Due to the greater demand for air and leisure travel during the summer months, revenues in the

airline industry in the second and third quarters of the year tend to be greater than revenues in the first and fourth quarters of the year. Our

results of operations will likely reflect weather factors and seasonality, and therefore quarterly results are not necessarily indicative of

those for an entire year, and our prior results are not necessarily indicative of our future results.

Increases in insurance costs or reductions in insurance coverage may adversely impact our operations and financial results.

The terrorist attacks of September 11, 2001 led to a significant increase in insurance premiums and a decrease in the insurance

coverage available to commercial air carriers. Accordingly, our insurance costs increased significantly and our ability to continue to

obtain insurance even at current prices remains uncertain. In addition, we have obtained third-party war risk (terrorism) insurance through

a special program administered by the FAA, resulting in lower premiums than if we had obtained this insurance in the commercial

insurance market. The program has been extended, with the same conditions and premiums, until August 31, 2010. If the federal

insurance program terminates, we would likely face a material increase in the cost of war risk insurance. The failure of one or more of our

insurers could result in a lack of coverage for a period of time. Additionally, severe disruptions in the domestic and global financial

markets could adversely impact the ratings and survival of some insurers. Future downgrades in the ratings of enough insurers could

adversely impact both the availability of appropriate insurance coverage and its cost. Because of competitive pressures in our industry,

our ability to pass additional insurance costs to passengers is limited. As a result, further increases in insurance costs or reductions in

available insurance coverage could have an adverse impact on our financial results.

We may be adversely affected by global events that affect travel behavior.

Our revenue and results of operations may be adversely affected by global events beyond our control. An outbreak of a contagious

disease such as Severe Acute Respiratory Syndrome ("SARS"), H1N1 influenza virus, avian flu, or any other influenza-type illness, if it

were to persist for an extended period, could again materially affect the airline industry and us by reducing revenues and impacting travel

behavior.

We are exposed to foreign currency exchange rate fluctuations.

As we expand our international operations, we will have significant operating revenues and expenses, as well as assets and liabilities,

denominated in foreign currencies. Fluctuations in foreign currencies can significantly affect our operating performance and the value of

our assets and liabilities located outside of the United States.

24