Travelers 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

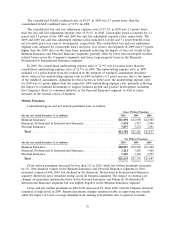

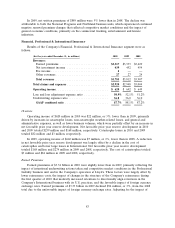

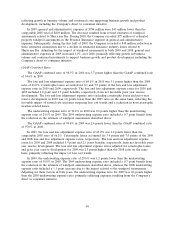

Written Premiums

Financial, Professional & International Insurance gross and net written premiums by market were

as follows:

Gross Written Premiums

(for the year ended December 31, in millions) 2010 2009 2008

Bond & Financial Products ........................ $2,133 $2,262 $2,378

International .................................. 1,401 1,451 1,588

Total Financial, Professional & International Insurance .$3,534 $3,713 $3,966

Net Written Premiums

(for the year ended December 31, in millions) 2010 2009 2008

Bond & Financial Products ........................ $1,981 $2,040 $2,126

International .................................. 1,230 1,245 1,342

Total Financial, Professional & International Insurance .$3,211 $3,285 $3,468

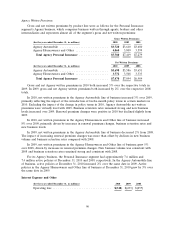

Gross and net written premiums in 2010 decreased 5% and 2%, respectively, compared with 2009.

Net written premiums for Bond & Financial Products in 2010 declined 3% from 2009, primarily

reflecting the impact of underwriting actions taken and competitive market conditions in the

Professional Liability and Public Company Liability business units. In addition, construction and

commercial surety gross and net written premium volume declined in 2010 compared with 2009,

reflecting the impact of the economic downturn. These factors were partially offset on a net basis by a

reduction in reinsurance costs. In International, the 1% decline in net written premiums in 2010

compared with 2009 primarily reflected the impact of intentional underwriting actions and competitive

market conditions. Those factors were largely offset by changes in the structure of the Company’s

reinsurance that modestly increased retentions to directionally align retentions in the Company’s

International business with its U.S. practices, as well as the favorable impact of foreign currency

exchange rates. In late 2008, the Company commenced an exclusive relationship with a broker in the

Republic of Ireland that significantly increased the 2009 volume of personal automobile coverage

written and also resulted in the Company writing personal household coverages. The Company ceased

writing business through this relationship in the fourth quarter of 2010.

Gross written premiums of $3.71 billion in 2009 decreased 6% from 2008, and net written

premiums of $3.29 billion in 2009 decreased 5% from 2008. The decline in gross and net written

premiums was primarily attributable to the unfavorable impact of foreign currency exchange rates in

International. The remainder of the decline was driven by the impact of the economic downturn on

construction and commercial surety business volume, underwriting actions taken and competitive

market conditions in the Professional Liability and Public Company Liability components of Bond &

Financial Products’ management liability business, partially offset by growth in Ireland.

In Bond & Financial Products (excluding the surety line of business, for which the following are

not relevant measures), business retention rates in 2010 were strong and slightly higher than in 2009.

Renewal premium changes in 2010 were negative, reflecting both a decline in renewal rate changes and

reduced insured exposures due to intentional underwriting actions taken and lower levels of economic

activity. New business volume in 2010 declined from 2009, which reflected increasingly competitive

market conditions in 2010. For International (also excluding the surety line of business), business

retention rates in 2010 declined from 2009. New business volume in International also declined in 2010,

primarily due to intentional underwriting actions and the termination of a broker relationship in

Ireland. Renewal premium changes were slightly positive in 2010, driven by positive renewal rate

changes, partially offset by reduced insured exposures.

86