Travelers 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292

|

|

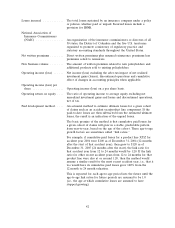

Runoff business ............ An operation which has been determined to be nonstrategic;

includes non-renewals of in-force policies and a cessation of writing

new business, where allowed by law.

Salvage .................. The amount of money an insurer recovers through the sale of

property transferred to the insurer as a result of a loss payment.

S-curve method ............ A mathematical function which depicts an initial slow change,

followed by a rapid change and then ending in a slow change again.

This results in an ‘‘S’’ shaped line when depicted graphically. The

actuarial application of these curves fit the reported data to date

for a particular cohort of claims to an S-curve to project future

activity for that cohort.

Second-injury fund .......... The employer of an injured, impaired worker is responsible only for

the workers’ compensation benefit for the most recent injury; the

second-injury fund would cover the cost of any additional benefits

for aggravation of a prior condition. The cost is shared by the

insurance industry and self-insureds, funded through assessments to

insurance companies and self-insureds based on either premiums or

losses.

Self-insured retentions ....... That portion of the risk retained by a person for its own account.

Servicing carrier ............ An insurance company that provides, for a fee, various services

including policy issuance, claims adjusting and customer service for

insureds in a reinsurance pool.

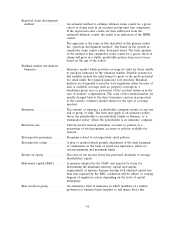

Statutory accounting practices

(SAP).................. The practices and procedures prescribed or permitted by domiciliary

state insurance regulatory authorities in the United States for

recording transactions and preparing financial statements. Statutory

accounting practices generally reflect a modified going concern basis

of accounting.

Statutory surplus ............ As determined under SAP, the amount remaining after all liabilities,

including loss reserves, are subtracted from all admitted assets.

Admitted assets are assets of an insurer prescribed or permitted by

a state to be recognized on the statutory balance sheet. Statutory

surplus is also referred to as ‘‘surplus’’ or ‘‘surplus as regards

policyholders’’ for statutory accounting purposes.

Structured settlements ........ Periodic payments to an injured person or survivor for a determined

number of years or for life, typically in settlement of a claim under

a liability policy, usually funded through the purchase of an annuity.

Subrogation ............... A principle of law incorporated in insurance policies, which enables

an insurance company, after paying a claim under a policy, to

recover the amount of the loss from another person or entity who is

legally liable for it.

Third-party liability .......... A liability owed to a claimant (third party) who is not one of the

two parties to the insurance contract. Insured liability claims are

referred to as third-party claims.

Total capitalization .......... The sum of total shareholders’ equity and debt.

45