Travelers 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

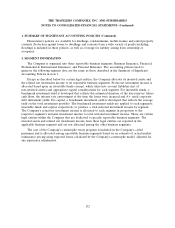

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Contractholder Receivables and Payables

Under certain workers’ compensation insurance contracts with deductible features, the Company is

obligated to pay the claimant for the full amount of the claim. The Company is subsequently

reimbursed by the policyholder for the deductible amount. These amounts are included on a gross basis

in the consolidated balance sheet in contractholder payables and contractholder receivables,

respectively.

Goodwill and Other Intangible Assets

The Company performs a review, on at least an annual basis, of goodwill held by the reporting

units which are the Company’s three operating and reportable segments: Business Insurance; Financial,

Professional & International Insurance; and Personal Insurance. The Company estimates the fair value

of its reporting units and compares it to their carrying value, including goodwill. If the carrying values

of the reporting units exceed their fair value, the amount of the impairment is calculated and goodwill

is adjusted accordingly.

The Company uses a discounted cash flow model to estimate the fair value of its reporting units.

The discounted cash flow model is an income approach to valuation that is based on a detailed cash

flow analysis for deriving a current fair value of reporting units and is representative of the Company’s

reporting units’ current and expected future financial performance. Other indefinite-lived intangible

assets held by the Company are also reviewed for impairment on at least an annual basis. The

classification of the asset as indefinite-lived is reassessed, and an impairment is recognized if the

carrying amount of the asset exceeds its fair value.

Intangible assets that are deemed to have a finite useful life are amortized over their useful lives.

The carrying amount of intangible assets with a finite useful life is regularly reviewed for indicators of

impairment in value. Impairment is recognized only if the carrying amount of the intangible asset is not

recoverable from its undiscounted cash flows and is measured as the difference between the carrying

amount and the fair value of the asset.

The Company’s review did not result in an impairment of its goodwill, other indefinite-lived

intangibles or finite-lived intangible assets and none of the Company’s reporting units were at risk for

failing the initial impairment test for the years ended December 31, 2010, 2009 and 2008.

Claims and Claim Adjustment Expense Reserves

Claims and claim adjustment expense reserves represent estimates for unpaid reported and

unreported claims incurred and related expenses. The reserves are adjusted regularly based upon

experience. Included in the claims and claim adjustment expense reserves in the consolidated balance

sheet are certain reserves discounted to the present value of estimated future payments. The liabilities

for losses for most long-term disability and annuity claim payments, primarily arising from workers’

compensation insurance and workers’ compensation excess insurance policies, were discounted using a

rate of 5% at both December 31, 2010 and 2009. These discounted reserves totaled $2.09 billion and

$2.16 billion at December 31, 2010 and 2009, respectively.

The Company performs a continuing review of its claims and claim adjustment expense reserves,

including its reserving techniques and its reinsurance. The reserves are also reviewed regularly by

qualified actuaries employed by the Company. These reserves represent the estimated ultimate cost of

165