Travelers 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

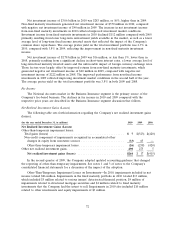

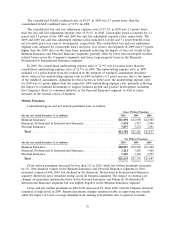

The consolidated GAAP combined ratio of 89.2% in 2009 was 2.7 points lower than the

consolidated GAAP combined ratio of 91.9% in 2008.

The consolidated loss and loss adjustment expense ratio of 57.3% in 2009 was 2.1 points lower

than the loss and loss adjustment expense ratio of 59.4% in 2008. Catastrophe losses accounted for 2.1

points and 5.8 points of the 2009 and 2008 loss and loss adjustment expense ratios, respectively. The

2009 and 2008 loss and loss adjustment expense ratios included 6.2 point and 7.1 point benefits from

net favorable prior year reserve development, respectively. The consolidated loss and loss adjustment

expense ratio adjusted for catastrophe losses and prior year reserve development in 2009 was 0.7 points

higher than the 2008 ratio on the same basis, primarily reflecting the impact of loss cost trends in the

Business Insurance and Personal Insurance segments, partially offset by lower non-catastrophe weather-

related losses across the Company’s segments, and fewer large property losses in the Financial,

Professional & International Insurance segment.

In 2009, the consolidated underwriting expense ratio of 31.9% was 0.6 points lower than the

consolidated underwriting expense ratio of 32.5% in 2008. The underwriting expense ratio in 2009

included a 0.4 point benefit from the reduction in the estimate of windpool assessments described

above, whereas the underwriting expense ratio in 2008 included a 0.7 point increase due to the impact

of the windpool assessments. Adjusting for these factors in both years, the underwriting expense ratio

for 2009 was 0.5 points higher than the respective 2008 underwriting expense ratio, primarily reflecting

the impact of continued investments to support business growth and product development, including

the Company’s direct to consumer initiative in the Personal Insurance segment, as well as salary

increases in the normal course of business.

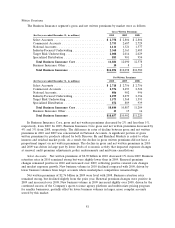

Written Premiums

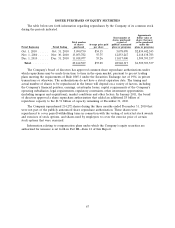

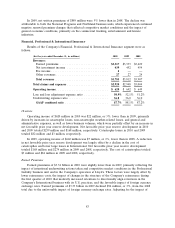

Consolidated gross and net written premiums were as follows:

Gross Written Premiums

(for the year ended December 31, in millions) 2010 2009 2008

Business Insurance ........................................ $11,891 $12,098 $12,580

Financial, Professional & International Insurance .................. 3,534 3,713 3,966

Personal Insurance ........................................ 7,877 7,474 7,291

Total ................................................ $23,302 $23,285 $23,837

Net Written Premiums

(for the year ended December 31, in millions) 2010 2009 2008

Business Insurance ........................................ $10,857 $10,902 $11,220

Financial, Professional & International Insurance .................. 3,211 3,285 3,468

Personal Insurance ........................................ 7,567 7,149 6,995

Total ................................................ $21,635 $21,336 $21,683

Gross written premiums increased by less than 1% in 2010, while net written premiums increased

by 1%. New business volume in the Business Insurance and Personal Insurance segments in 2010

increased compared with 2009, but declined in the Financial, Professional & International Insurance

segment. Retention rates remained strong across all business segments. The impact of renewal rate

changes on premiums remained positive in the Personal Insurance and Financial, Professional &

International Insurance segments but was slightly negative in the Business Insurance segment.

Gross and net written premiums in 2009 both decreased 2% from 2008. Overall, business retention

remained at high levels in 2009. Renewal premium changes remained stable as improving rate trends

offset the impact of lower coverage demands from existing policyholders due to general economic

76