Travelers 2010 Annual Report Download - page 30

Download and view the complete annual report

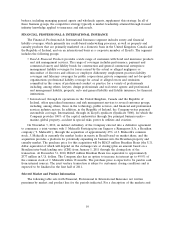

Please find page 30 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CLAIMS MANAGEMENT

The Company’s claim functions are managed through its Claims Services operation, with locations

in the United States and in the countries where it does business. With more than 14,000 employees,

Claims Services employs a diverse group of professionals, including claim adjusters, appraisers,

attorneys, investigators, engineers, accountants, system specialists and training, management and

support personnel. Approved external service providers, such as independent adjusters and appraisers,

investigators and attorneys, are available for use as appropriate.

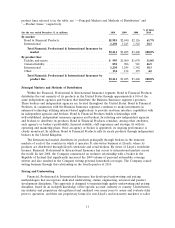

U.S. field claim management teams located in 26 claim centers and 55 satellite and specialty-only

offices in 46 states are organized to maintain focus on the specific claim characteristics unique to the

businesses within the Company’s business segments. Claim teams with specialized skills, resources, and

workflows are matched to the unique exposures of those businesses, with local claims management

dedicated to achieving optimal results within each segment. The Company’s home office operations

provide additional support in the form of workflow design, quality management, information

technology, advanced management information and data analysis, training, financial reporting and

control, and human resources strategy. This structure permits the Company to maintain the economies

of scale of a large, established company while retaining the agility to respond promptly to the needs of

customers, brokers, agents and underwriters. Claims management for International is generally

provided locally by staff in the respective international locations due to local knowledge of applicable

laws and regulations, although it is also managed by the Company’s U.S. Claims Services organization

to leverage that knowledge base and to share best practices.

An integral part of the Company’s strategy to benefit customers and shareholders is its continuing

industry leadership in the fight against insurance fraud through its Investigative Services unit. The

Company has a nationwide staff of experts that investigate a wide array of insurance fraud schemes

using in-house forensic resources and other technological tools. This staff also has specialized expertise

in fire scene examinations, medical provider fraud schemes and data mining. The Company also

dedicates investigative resources to ensure that violations of law are reported to and prosecuted by law

enforcement agencies.

Claims Services uses advanced technology, management information, and data analysis to assist the

Company in reviewing its claim practices and results to evaluate and improve its claims management

performance. The Company’s claims management strategy is focused on segmentation of claims and

appropriate technical specialization to drive effective claim resolution. The Company continually

monitors its investment in claim resources to maintain an effective focus on claim outcomes and a

disciplined approach to continual improvement. The Company operates a state-of-the-art claims

training facility, offering hands-on experiential learning to help ensure that its claim professionals are

properly trained. In recent years, the Company has invested significant additional resources in many of

its claim handling operations and routinely monitors the effect of those investments to ensure a

consistent optimization among outcomes, cost and service.

In recent years, Claims Services refined its catastrophe response strategy to increase the

Company’s ability to respond to a significant catastrophic event using its own personnel, enabling it to

minimize reliance on independent adjustors and appraisers. The Company has developed a large

dedicated catastrophe response team and trained a large Enterprise Response Team of existing

employees who can be deployed on short notice in the event of a catastrophe that generates claim

volume exceeding the capacity of the dedicated catastrophe response team. In recent years, these

internal resources were successfully deployed to respond to a record number of catastrophe claims,

including those resulting from Hurricanes Ike, Gustav and Dolly in 2008.

The Company continues to develop effective claim solutions that provide superior customer

service. One example of this is the Company’s auto claim service that features three Company-owned

auto repair facilities and selected independently-owned auto repair facilities with Company appraisers

18