Travelers 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

however, hurricanes and earthquakes may produce significant damage in larger areas, especially those

areas that are heavily populated. The Company generally seeks to manage its exposure to catastrophes

through individual risk selection and the purchase of catastrophe reinsurance. The Company utilizes a

general catastrophe reinsurance treaty with unaffiliated reinsurers to manage its exposure to losses

resulting from catastrophes. In addition to the coverage provided under this treaty, the Company also

utilizes a catastrophe bond program, as well as a Northeast catastrophe reinsurance treaty, to protect

against certain losses resulting from catastrophes in the Northeastern United States.

General Catastrophe Reinsurance Treaty. The general catastrophe reinsurance treaty covers the

accumulation of net property losses arising out of one occurrence. The treaty covers all of the

Company’s exposures in the United States and Canada and their possessions and waters contiguous

thereto, the Caribbean and Mexico. The treaty only provides coverage for terrorism events in limited

circumstances and excludes entirely losses arising from nuclear, biological, chemical or radiological

attacks.

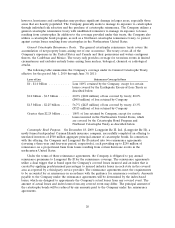

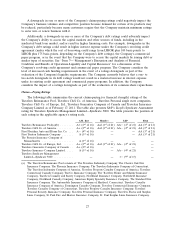

The following table summarizes the Company’s coverage under its General Catastrophe Treaty,

effective for the period July 1, 2010 through June 30, 2011:

Layer of Loss Reinsurance Coverage In-Force

$0 - $1.0 billion ............ Loss 100% retained by the Company, except for certain

losses covered by the Earthquake Excess-of-Loss Treaty as

described below

$1.0 billion - $1.5 billion ...... 20.0% ($100 million) of loss covered by treaty; 80.0%

($400 million) of loss retained by Company

$1.5 billion - $2.25 billion ..... 56.7% ($425 million) of loss covered by treaty; 43.3%

($325 million) of loss retained by Company

Greater than $2.25 billion ..... 100% of loss retained by Company, except for certain

losses incurred in the Northeastern United States, which

are covered by the Catastrophe Bond Program and

Northeast Catastrophe Treaty as described below.

Catastrophe Bond Program. On December 18, 2009, Longpoint Re II, Ltd. (Longpoint Re II), a

newly formed independent Cayman Islands insurance company, successfully completed an offering to

unrelated investors of $500 million aggregate principal amount of catastrophe bonds. In connection

with the offering, the Company and Longpoint Re II entered into two reinsurance agreements

(covering a three-year and four-year period, respectively), each providing up to $250 million of

reinsurance on a proportional basis from losses resulting from certain hurricane events in the

northeastern United States.

Under the terms of these reinsurance agreements, the Company is obligated to pay annual

reinsurance premiums to Longpoint Re II for the reinsurance coverage. The reinsurance agreements

utilize a dual trigger that is based upon the Company’s covered losses incurred and an index that is

created by applying predetermined percentages to insured industry losses in each state in the covered

area as reported by a third-party service provider. The reinsurance agreements meet the requirements

to be accounted for as reinsurance in accordance with the guidance for reinsurance contracts. Amounts

payable to the Company under the reinsurance agreements will be determined by the index-based

losses, which are designed to approximate the Company’s actual losses from any covered event. The

amount of actual losses and index losses from any covered event may differ. The principal amount of

the catastrophe bonds will be reduced by any amounts paid to the Company under the reinsurance

agreements.

20