Travelers 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.relating to 2007 flood losses. In Bond & Financial Products, better than expected loss development for

the contract surety business within the fidelity and surety product line, resulting from favorable

settlements on large claims (primarily from accident years prior to 2005), resulted in net favorable prior

year reserve development in 2008.

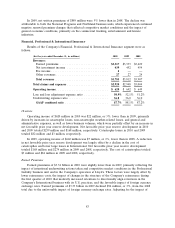

The amortization of deferred acquisition costs totaled $612 million in 2010, $10 million, or 2%,

lower than the comparable 2009 total of $622 million, consistent with the decline in earned premiums.

In 2009, the amortization of deferred acquisition costs totaled $622 million, $30 million, or 5%, lower

than the comparable 2008 total of $652 million, driven by the favorable impact of foreign currency

exchange rates and changes in the mix of business.

General and administrative expenses in 2010 totaled $608 million, $29 million, or 5%, higher than

the 2009 total of $579 million. The increase in 2010 primarily reflected increases in employee- and

technology-related costs to enhance operations and support future business growth. In 2009, general

and administrative expenses of $579 million were slightly lower than the 2008 total of $581 million,

primarily reflecting the favorable impact of foreign currency exchange rates, which was largely offset by

an increase in employee-related expenses associated with growth initiatives.

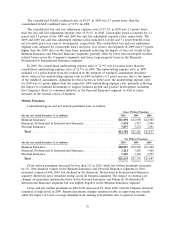

GAAP Combined Ratio

The GAAP combined ratio of 87.7% in 2010 was 0.4 points lower than the GAAP combined ratio

of 88.1% in 2009.

The loss and loss adjustment expense ratio of 50.9% in 2010 was 1.2 points lower than the 2009

ratio of 52.1%. Catastrophe losses in 2010 and 2009 accounted for 2.4 and 0.1 points of the loss and

loss adjustment expense ratio, respectively. The loss and loss adjustment expense ratios in 2010 and

2009 included 7.8 point and 5.1 point benefits, respectively, from net favorable prior year reserve

development. The loss and loss adjustment expense ratio in 2010 excluding catastrophe losses and prior

year reserve development was 0.8 points lower than the 2009 ratio on the same basis, reflecting lower

reinsurance costs, partially offset by an increase in non-catastrophe weather-related losses. In addition,

the 2009 ratio reflected a reserve increase for a non-renewed professional liability program in Ireland.

The underwriting expense ratio of 36.8% in 2010 was 0.8 points higher than the underwriting

expense ratio of 36.0% in 2009. The increase primarily reflected the impact of increases in employee-

and technology-related costs to enhance operations and support future business growth.

The GAAP combined ratio of 88.1% in 2009 was 0.9 points higher than the GAAP combined ratio

of 87.2% in 2008.

In 2009, the loss and loss adjustment expense ratio of 52.1% was 0.9 points higher than the 2008

ratio of 51.2%. Catastrophe losses in 2009 and 2008 accounted for 0.1 and 2.3 points of the loss and

loss adjustment expense ratio, respectively. The loss and loss adjustment expense ratios in 2009 and

2008 included 5.1 point and 8.0 point benefits, respectively, from net favorable prior year reserve

development. The loss and loss adjustment expense ratio in 2009 adjusted for catastrophe losses and

prior year reserve development was 0.2 points higher than the 2008 ratio on the same basis, as the

impact of loss cost trends was partially offset by the favorable impact of lower large losses in

International.

In 2009, the underwriting expense ratio of 36.0% was level with the underwriting expense ratio in

2008. The 2008 expense ratio included a 0.2 point impact from hurricane-related assessments. Adjusting

for that factor in 2008, the 2009 underwriting expense ratio was 0.2 points higher than the 2008 ratio.

85