Travelers 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.primarily concentrated in the general liability, commercial multi-peril, commercial automobile and

commercial property product lines for recent accident years, reflecting greater reductions in frequency

than the Company expected based upon long-term frequency trends that have been declining. The

general liability and commercial multi-peril product lines experienced better than anticipated loss

development that was attributable to several factors, including what the Company believes to be

improved legal and judicial environments, as well as enhanced risk control, underwriting and claim

process initiatives. The commercial automobile line of business experienced better than expected loss

development that was attributable to what the Company believes to be more favorable legal and

judicial environments, claim handling initiatives and improvements in auto safety technology. The

commercial property product line improvement primarily occurred in the 2007 and 2008 accident years

as a result of better than expected loss development for certain large national property and inland

marine exposures. In addition, the commercial property product line’s 2005 accident year experience

improved due to the litigation environment relating to, and ongoing claim settlements for, Hurricane

Katrina. The net favorable prior year reserve development in these product lines in 2009 was partially

offset by $185 million and $70 million increases to asbestos reserves and environmental reserves,

respectively (discussed in more detail in the ‘‘Asbestos Claims and Litigation’’ and ‘‘Environmental

Claims and Litigation’’ sections herein).

Net favorable prior year development in 2008 was driven by better than expected loss development

primarily concentrated in the general liability and commercial multi-peril product lines, an increase in

anticipated ceded reinsurance recoveries for older accident years in the general liability product line

and better than anticipated loss development in the commercial property and commercial automobile

product lines. The net favorable prior year reserve development in the general liability and commercial

multi-peril lines was attributable to several factors, including improved legal and judicial environments,

as well as enhanced risk control, underwriting and claim process initiatives. The commercial property

product line improvement occurred primarily in the 2007 accident year as a result of better than

expected loss development for certain large national property, national programs, and ocean marine

claim exposures and lower than expected weather-related losses during the last half of 2007, as well as

favorable loss development in certain large inland marine claim exposures and in ceded reinsurance

recoveries for commercial property large claims. In addition, the commercial multi-peril and property

product lines’ 2005 accident year results experienced improvement due to the litigation environment

relating to, and ongoing claim settlements for, Hurricane Katrina. The commercial automobile product

line improvement was attributable to several factors, including improved legal and judicial

environments, as well as enhanced risk control, underwriting and claim process initiatives. The net

favorable prior year reserve development in the foregoing product lines in 2008 was partially offset by

net unfavorable prior year reserve development in the workers’ compensation product line, primarily

driven by higher than anticipated medical costs related to 2004 and prior accident years, and by

$70 million and $85 million increases to asbestos and environmental reserves, respectively (discussed in

more detail in the ‘‘Asbestos Claims and Litigation’’ and ‘‘Environmental Claims and Litigation’’

sections herein).

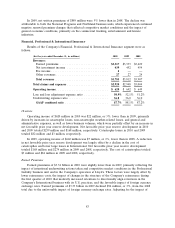

The amortization of deferred acquisition costs totaled $1.75 billion in 2010, $26 million lower than

the comparable total of $1.78 billion in 2009. In 2009, the total of $1.78 billion was $43 million lower

than the 2008 total of $1.82 billion. The declines in both years were consistent with the declines in

earned premiums.

General and administrative expenses in 2010 totaled $1.90 billion, $62 million, or 3%, lower than

in 2009. The 2009 total included a $38 million reduction in the estimate of property windpool

assessments related to Hurricane Ike. Adjusting for that reduction in 2009, general and administrative

expenses in 2010 were $100 million, or 5%, lower than in 2009, driven by a decline in loss-based

assessments that reflected the impact of favorable prior year reserve development and favorable rate

changes, as well as a decline in employee-related expenses and a reduction in the amount of the

79