Travelers 2010 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

various reinsurance agreements. The Company employs dedicated specialists and aggressive strategies

to manage reinsurance collections and disputes.

The reinsurance agreements that the Company entered into as part of its catastrophe bond

programs are dual trigger contracts and meet the requirements to be accounted for as reinsurance in

accordance with guidance for accounting for reinsurance contracts. The Company’s catastrophe bond

programs are described in more detail in the ‘‘Catastrophe Reinsurance Coverage’’ section herein.

The Company reports its reinsurance recoverables net of an allowance for estimated uncollectible

reinsurance recoverables. The allowance is based upon the Company’s ongoing review of amounts

outstanding, length of collection periods, changes in reinsurer credit standing, disputes, applicable

coverage defenses and other relevant factors. Accordingly, the establishment of reinsurance

recoverables and the related allowance for uncollectible reinsurance recoverables is also an inherently

uncertain process involving estimates. From time to time, as a result of the long-tailed nature of the

underlying liabilities, coverage complexities and potential for disputes, the Company considers the

commutation of reinsurance contracts. Changes in estimated reinsurance recoverables and commutation

activity could result in additional income statement charges.

Recoverables attributable to structured settlements relate primarily to personal injury claims, of

which workers’ compensation claims comprise a significant portion, for which the Company has

purchased annuities and remains contingently liable in the event of a default by the companies issuing

the annuities. Recoverables attributable to mandatory pools and associations relate primarily to

workers’ compensation service business. These recoverables are supported by the participating

insurance companies’ obligation to pay a pro rata share based on each company’s voluntary market

share of written premium in each state in which it is a pool participant. In the event a member of a

mandatory pool or association defaults on its share of the pool’s or association’s obligations, the other

members’ share of such obligation increases proportionally.

On August 20, 2010, in a reinsurance dispute in New York state court captioned United States

Fidelity & Guaranty Company v. American Re-Insurance Company, et al., the trial court granted summary

judgment for the Company, and on October 25, 2010, entered judgment awarding the Company

$251 million plus pre-judgment interest in the amount of $169 million. The judgment, including the

award of interest, has been appealed. See note 15 of notes to the Company’s consolidated financial

statements for further discussion of this reinsurance dispute.

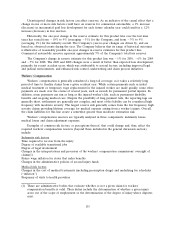

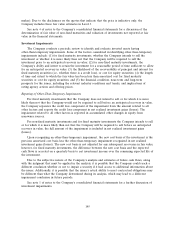

The following table summarizes the composition of the Company’s reinsurance recoverable assets:

(at December 31, in millions) 2010 2009

Gross reinsurance recoverables on paid and unpaid claims and

claim adjustment expenses ........................... $ 6,934 $ 8,138

Allowance for uncollectible reinsurance ................... (363) (523)

Net reinsurance recoverables .......................... 6,571 7,615

Structured settlements ............................... 3,380 3,456

Mandatory pools and associations ....................... 1,568 1,745

Total reinsurance recoverables ......................... $11,519 $12,816

The $1.04 billion decline in net reinsurance recoverables since December 31, 2009 reflected cash

collections and the impact of net favorable prior year reserve development, partially offset by a

reduction in the allowance for uncollectible reinsurance that included the impact of a $70 million

benefit resulting from the summary judgment in the reinsurance dispute referenced above. As a result,

at December 31, 2010, reinsurance recoverables included the full $251 million owed to the Company

under the terms of the related reinsurance agreement.

142