Travelers 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.While economic conditions have recently improved, there is continued uncertainty regarding the

timing and strength of any economic recovery. The trend may not continue. Further, if growth

continues, it may be at a slow rate for an extended period of time. In addition, other economic

conditions, such as the commercial and residential real estate environment and employment rates, may

continue to be weak. If weak economic conditions persist or deteriorate, low levels of economic activity

could impact exposure changes at renewal and our ability to write business at acceptable rates.

Additionally, such low levels of economic activity could adversely impact audit premium adjustments,

policy endorsements and mid-term cancellations after policies are written. All of the foregoing, in turn,

could adversely impact net written premiums in 2011. Since earned premiums lag net written premiums,

earned premiums could be adversely impacted in 2011 and into 2012.

Underwriting Gain/Loss. In Business Insurance, the anticipated impact of competitive market

conditions and general economic conditions on the Company’s earned premiums, as discussed above,

coupled with an expected modest increase in loss costs, will likely result in modestly reduced

underwriting profitability during 2011, as compared with 2010. In Financial, Professional &

International Insurance, the anticipated impact of a decline in earned premiums resulting from lower

levels of written premiums in 2010, combined with higher employee- and technology-related costs to

enhance operations and support future business growth, will likely result in modestly reduced

underwriting profitability during 2011 as compared with 2010. In Personal Insurance, the anticipated

impact of continued positive renewal premium changes on the Company’s earned premiums, as

discussed above, combined with an expected modest increase in loss costs, will likely result in modestly

increased underwriting profitability during 2011, as compared with 2010. In Personal Insurance, the

Company’s direct to consumer initiative, discussed above, while intended to enhance the Company’s

long-term ability to compete successfully in a consumer-driven marketplace, is expected to remain

unprofitable for a number of years as this book of business grows and matures.

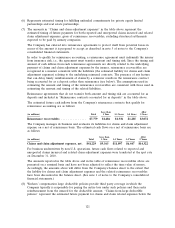

In recent periods, the Company has experienced net favorable prior year reserve development,

driven by better than expected loss experience in all of the Company’s segments, primarily in accident

years 2001 through 2007. Better than expected loss experience and other favorable circumstances may

continue at higher, lower or the same levels as compared to recent periods, may not continue or may

reverse, causing the Company to recognize higher, lower or the same levels of favorable prior year

reserve development, no favorable prior year reserve development or unfavorable prior year reserve

development in future periods. In addition, the ongoing review of prior year claim and claim

adjustment expense reserves, or other changes in current period circumstances, may result in the

Company revising current year loss estimates upward or downward in future periods.

Catastrophe losses are inherently unpredictable from year to year, and the Company’s results of

operations would be adversely impacted by significant catastrophe losses in 2011.

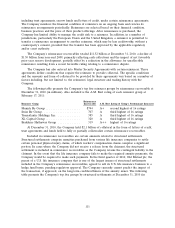

Investment Portfolio. The Company expects to continue to focus its investment strategy on

maintaining a high-quality investment portfolio and a relatively low average effective duration.

Net investment income is a material contributor to the Company’s results of operations. While

interest rates have recently risen above the historic lows experienced in the second half of 2010, the

Company expects investment returns for its fixed maturity investment portfolio to be slightly lower in

2011 than in recent periods due to lower reinvestment yields available for maturing long-term fixed

maturity investments. Short-term interest rates are expected to remain at or near historically low levels.

The Company expects investment income in its non-fixed maturity investment portfolio in 2011 to be

generally consistent with 2010. However, if general economic conditions and/or investment market

conditions deteriorate in 2011, the Company could also experience a reduction in net investment

income and/or significant realized investment losses, including impairments. The Company expects its

fixed income assets, including its municipal portfolio, to provide adequate risk-adjusted returns and

support its insurance operations over the long-term. For further discussion of the Company’s municipal

113