Travelers 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accounts. This increase included a $70 million benefit from the reduction in the allowance for

uncollectible reinsurance resulting from a recent favorable ruling related to a reinsurance dispute and

an increase in estimated reinsurance recoverables. In 2009, the Company recorded a $185 million

increase in asbestos reserves, primarily driven by a slight increase in the Company’s assumption for

projected defense costs related to many policyholders. The Company recorded a $70 million increase to

asbestos reserves in 2008, which was driven by a change in the estimated costs associated with litigating

asbestos coverage matters and a change in estimated losses for certain individual policyholders. Overall,

the company’s assessment of the underlying asbestos environment did not change significantly from

recent periods.

Net asbestos losses paid in 2010, 2009 and 2008 were $350 million, $341 million and $658 million,

respectively. (Asbestos payments in 2008 included the Company’s one-time net payment of $365 million

associated with the settlement of the ACandS, Inc. matter). Approximately 32%, 41% and 59% of total

net paid losses in 2010, 2009 and 2008, respectively, related to policyholders with whom the Company

had entered into settlement agreements limiting the Company’s liability.

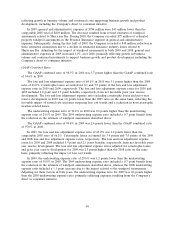

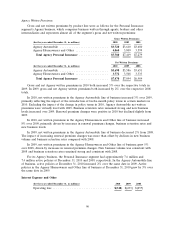

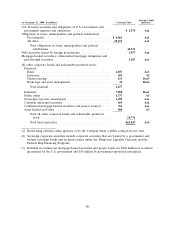

The Company categorizes its asbestos reserves as follows:

Number of Net Asbestos

Policyholders Total Net Paid Reserves

(at and for the year ended December 31, $ in millions) 2010 2009 2010 2009 2010 2009

Policyholders with settlement agreements .......... 17 18 $112 $139 $ 583 $ 621

Home office and field office .................... 1,705 1,697 209 176 1,778 1,956

Assumed reinsurance and other ................. ——29 26 187 181

Total ................................... 1,722 1,715 $350 $341 $2,548 $2,758

The ‘‘policyholders with settlement agreements’’ category includes structured settlements, coverage

in place arrangements and, with respect to TPC, Wellington accounts. Reserves are based on the

expected payout for each policyholder under the applicable agreement. Structured settlements are

arrangements under which policyholders and/or plaintiffs agree to fixed financial amounts to be paid at

scheduled times. Included in this category are TPC’s reserves for the settlements of the Statutory and

Hawaii Actions and the Common Law Claims. (For a description of these matters, see note 15 of notes

to the consolidated financial statements). Coverage in place arrangements represent agreements with

policyholders on specified amounts of coverage to be provided. Payment obligations may be subject to

annual maximums and are only made when valid claims are presented. Wellington accounts refer to the

35 defendants that are parties to a 1985 agreement settling certain disputes concerning insurance

coverage for their asbestos claims. Many of the aspects of the Wellington agreement are similar to

those of coverage in place arrangements in which the parties have agreed on specific amounts of

coverage and the terms under which the coverage can be accessed.

The ‘‘home office and field office’’ category relates to all other policyholders and also includes

unallocated IBNR reserves and reserves for the costs of defending asbestos-related coverage litigation.

Policyholders are identified for the annual home office review based upon, among other factors: a

combination of past payments and current case reserves in excess of a specified threshold (currently

$100,000), perceived level of exposure, number of reported claims, products/completed operations and

potential ‘‘non-product’’ exposures, size of policyholder and geographic distribution of products or

services sold by the policyholder. In addition to IBNR amounts contained in the reserves for ‘‘home

office and field office’’ policyholders and the costs of litigating asbestos coverage matters, the Company

has established a reserve for further adverse development related to existing policyholders, new claims

from policyholders reporting claims for the first time and policyholders for which there is, or may be,

litigation and direct actions against the Company. The ‘‘assumed reinsurance and other’’ category

primarily consists of reinsurance of excess coverage, including various pool participations.

94