Travelers 2010 Annual Report Download - page 101

Download and view the complete annual report

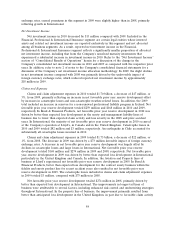

Please find page 101 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reflecting growth in business volume and continued costs supporting business growth and product

development, including the Company’s direct to consumer initiative.

In 2009, general and administrative expenses of $784 million were $45 million lower than the

comparable 2008 total of $829 million. The decrease resulted from revised estimates of windpool

assessments related to Hurricane Ike. During 2008, the Company recorded $77 million of estimated

property windpool assessments in the Personal Insurance segment in general and administrative

expenses. Subsequently, during the first half of 2009, the Company recorded a $48 million reduction in

these estimated assessments due to a decline in estimated insurance industry losses related to

Hurricane Ike. Adjusting for the impact of windpool assessments in both 2009 and 2008, general and

administrative expenses in 2009 increased 11%, over 2008, primarily reflecting growth in business

volume and continued investments to support business growth and product development, including the

Company’s direct to consumer initiative.

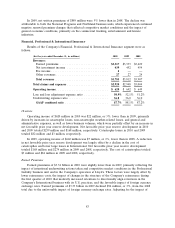

GAAP Combined Ratio

The GAAP combined ratio of 98.3% in 2010 was 3.7 points higher than the GAAP combined ratio

of 94.6% in 2009.

The loss and loss adjustment expense ratio of 68.1% in 2010 was 3.1 points higher than the 2009

ratio of 65.0%. Catastrophe losses accounted for 8.1 and 3.9 points of the loss and loss adjustment

expense ratio in 2010 and 2009, respectively. The loss and loss adjustment expense ratios for 2010 and

2009 included 1.2 point and 1.9 point benefits, respectively, from net favorable prior year reserve

development. The loss and loss adjustment expense ratio excluding catastrophe losses and prior year

reserve development in 2010 was 1.8 points lower than the 2009 ratio on the same basis, reflecting the

favorable impact of earned rate increases outpacing loss cost trends and a reduction in non-catastrophe

weather-related losses.

The underwriting expense ratio of 30.2% in 2010 was 0.6 points higher than the underwriting

expense ratio of 29.6% in 2009. The 2009 underwriting expense ratio included a 0.7 point benefit from

the reduction in the estimate of windpool assessments described above.

The GAAP combined ratio of 94.6% in 2009 was 2.4 points lower than the GAAP combined ratio

of 97.0% in 2008.

In 2009, the loss and loss adjustment expense ratio of 65.0% was 1.2 points lower than the

comparable 2008 ratio of 66.2%. Catastrophe losses accounted for 3.9 points and 7.8 points of the 2009

and 2008 loss and loss adjustment expense ratios, respectively. The loss and loss adjustment expense

ratios for 2009 and 2008 included 1.9 point and 2.1 point benefits, respectively, from net favorable prior

year reserve development. The loss and loss adjustment expense ratios adjusted for catastrophe losses

and prior year reserve development for 2009 was 2.5 points higher than the 2008 ratio on the same

basis, primarily reflecting the impact of loss cost trends.

In 2009, the underwriting expense ratio of 29.6% was 1.2 points lower than the underwriting

expense ratio of 30.8% in 2008. The 2009 underwriting expense ratio included a 0.7 point benefit from

the reduction in the estimate of windpool assessments described above, whereas the 2008 underwriting

expense ratio included a 1.1 point increase due to the impact related to the windpool assessments.

Adjusting for these factors in both years, the underwriting expense ratio for 2009 was 0.6 points higher

than the 2008 underwriting expense ratio, primarily reflecting expenses resulting from the Company’s

direct to consumer initiative.

89