Travelers 2010 Annual Report Download - page 127

Download and view the complete annual report

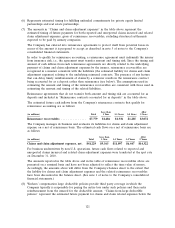

Please find page 127 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company currently utilizes uncollateralized letters of credit issued by major banks with an

aggregate limit of approximately $537 million to provide much of the capital needed to support its

obligations at Lloyd’s. If uncollateralized letters of credit are not available at a reasonable price or at

all in the future, the Company can collateralize these letters of credit or may have to seek alternative

means of supporting its obligations at Lloyd’s, which could include utilizing holding company funds on

hand.

Operating Activities

Net cash flows provided by operating activities totaled $3.05 billion, $4.23 billion and $3.14 billion

in 2010, 2009 and 2008, respectively. Cash flows in 2010 reflected a higher level of claims and claim

adjustment expense payments due to the impact of loss cost trends and a higher level of catastrophe

loss payments, as well as a lower level of reinsurance recoveries, partially offset by declines in the

amount of contributions to the Company’s pension plan and lower claims and claim adjustment expense

payments related to operations in runoff as compared with 2009. Cash flows in 2009 reflected a decline

in catastrophe loss payments, a higher level of reinsurance recoveries, a reduction in the amount of

contributions to the Company’s pension plan and lower claims and claim adjustment expense payments

related to operations in runoff as compared with 2008. Those runoff payments in 2008 included the

Company’s one-time net payment of $365 million associated with the final settlement of asbestos claims

related to ACandS, Inc. In the years ended December 31, 2010, 2009 and 2008, the Company

contributed $35 million, $260 million and $450 million, respectively, to its pension plan.

Investing Activities

Net cash flows provided by investing activities totaled $2.11 billion in 2010, compared with net cash

flows used in investing activities of $899 million and $162 million in 2009 and 2008, respectively. The

Company’s consolidated total investments at December 31, 2010 decreased by $2.24 billion from

year-end 2009, driven by the net sales and maturities of fixed maturity investments. The proceeds from

those sales and maturities, along with operating cash flows of $3.05 billion in 2010, were the primary

sources of funding for the Company’s $5.04 billion of common share repurchases in 2010. Net pretax

unrealized appreciation of investments at December 31, 2010 was virtually unchanged from the same

date in 2009. The Company’s consolidated total investments at December 31, 2009 increased by

$4.23 billion from year-end 2008, primarily reflecting a $3.08 billion pretax increase in the unrealized

appreciation of investments since year-end 2008 and investment purchases resulting from strong cash

flows from operations, partially offset by $3.29 billion of common share repurchases made during 2009.

The improvement in the Company’s net unrealized investment gain position at December 31, 2009 over

the prior year is primarily attributable to the Company’s fixed maturity investments. The improved

valuations on these holdings reflect the changing market conditions in 2009 which included a significant

narrowing of credit spreads.

In the first half of 2011, the Company expects to fund its investment in J. Malucelli with cash from

internal sources. See ‘‘Part I—Item 1—Financial, Professional & International Insurance’’ in this report

for further information regarding this investment.

The primary goals of the Company’s asset—liability management process are to satisfy the

insurance liabilities and maintain sufficient liquidity to cover fluctuations in projected liability cash

flows. Generally, the expected principal and interest payments produced by the Company’s fixed

maturity portfolio adequately fund the estimated runoff of the Company’s insurance reserves. Although

this is not an exact cash flow match in each period, the substantial degree by which the market value of

the fixed maturity portfolio exceeds the expected present value of the net insurance liabilities, as well

as the positive cash flow from newly sold policies and the large amount of high quality liquid bonds,

contributes to the Company’s ability to fund claim payments without having to sell illiquid assets or

access credit facilities.

115