Travelers 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A downgrade in one or more of the Company’s claims-paying ratings could negatively impact the

Company’s business volumes and competitive position because demand for certain of its products may

be reduced, particularly because many customers require that the Company maintain minimum ratings

to enter into or renew business with it.

Additionally, a downgrade in one or more of the Company’s debt ratings could adversely impact

the Company’s ability to access the capital markets and other sources of funds, including in the

syndicated bank loan market, and/or result in higher financing costs. For example, downgrades in the

Company’s debt ratings could result in higher interest expense under the Company’s revolving credit

agreement (under which the cost of borrowing could range from LIBOR plus 100 basis points to

LIBOR plus 175 basis points, depending on the Company’s debt ratings), the Company’s commercial

paper program, or in the event that the Company were to access the capital markets by issuing debt or

similar types of securities. See ‘‘Item 7—‘‘Management’s Discussion and Analysis of Financial

Condition and Results of Operations-Liquidity and Capital Resources’’ for a discussion of the

Company’s revolving credit agreement and commercial paper program. The Company considers the

level of increased cash funding requirements in the event of a ratings downgrade as part of the

evaluation of the Company’s liquidity requirements. The Company currently believes that a one- to

two-notch downgrade in its debt ratings would not result in a material increase in interest expense

under its existing credit agreement and commercial paper programs. In addition, the Company

considers the impact of a ratings downgrade as part of the evaluation of its common share repurchases.

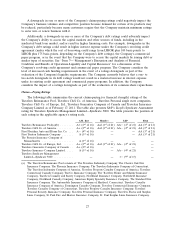

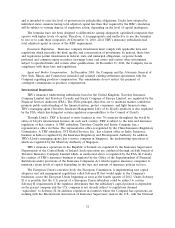

Claims—Paying Ratings

The following table summarizes the current claims-paying (or financial strength) ratings of the

Travelers Reinsurance Pool, Travelers C&S Co. of America, Travelers Personal single state companies,

Travelers C&S Co. of Europe, Ltd., Travelers Guarantee Company of Canada and Travelers Insurance

Company Limited as of February 17, 2011. The table also presents S&P’s Lloyd’s Syndicate Assessment

rating for Travelers Syndicate Management Limited—Syndicate 5000. The table presents the position of

each rating in the applicable agency’s rating scale.

A.M. Best Moody’s S&P Fitch

Travelers Reinsurance Pool(a)(b) ........ A+ (2

nd of 16) Aa2 (3rd of 21) AA (4th of 21) AA (3rd of 21)

Travelers C&S Co. of America .......... A+ (2

nd of 16) Aa2 (3rd of 21) AA (4th of 21) AA (3rd of 21)

First Floridian Auto and Home Ins. Co. . . . A (4th of 16) — — AA (3rd of 21)

First Trenton Indemnity Company ....... A (3

rd of 16) — — AA (3rd of 21)

The Premier Insurance Company of

Massachusetts ................... A (3

rd of 16) — — —

Travelers C&S Co. of Europe, Ltd. ...... A+ (2

nd of 16) Aa2 (3rd of 21) AA (4th of 21) —

Travelers Guarantee Company of Canada . . A+ (2nd of 16) — — —

Travelers Insurance Company Limited ..... A (3

rd of 16) — AA (4th of 21) —

Travelers Syndicate Management

Limited—Syndicate 5000 ............ — — 3 (9th of 15) —

(a) The Travelers Reinsurance Pool consists of: The Travelers Indemnity Company, The Charter Oak Fire

Insurance Company, The Phoenix Insurance Company, The Travelers Indemnity Company of Connecticut,

The Travelers Indemnity Company of America, Travelers Property Casualty Company of America, Travelers

Commercial Casualty Company, TravCo Insurance Company, The Travelers Home and Marine Insurance

Company, Travelers Casualty and Surety Company, Northland Insurance Company, Northfield Insurance

Company, Northland Casualty Company, American Equity Specialty Insurance Company, The Standard Fire

Insurance Company, The Automobile Insurance Company of Hartford, Connecticut, Travelers Casualty

Insurance Company of America, Farmington Casualty Company, Travelers Commercial Insurance Company,

Travelers Casualty Company of Connecticut, Travelers Property Casualty Insurance Company, Travelers

Personal Security Insurance Company, Travelers Personal Insurance Company, Travelers Excess and Surplus

Lines Company, St. Paul Fire and Marine Insurance Company, St. Paul Surplus Lines Insurance Company,

27