Travelers 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295

|

|

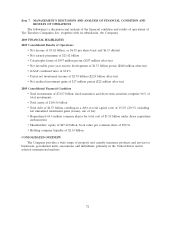

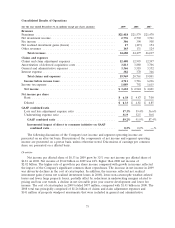

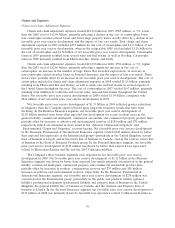

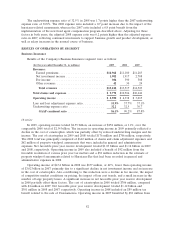

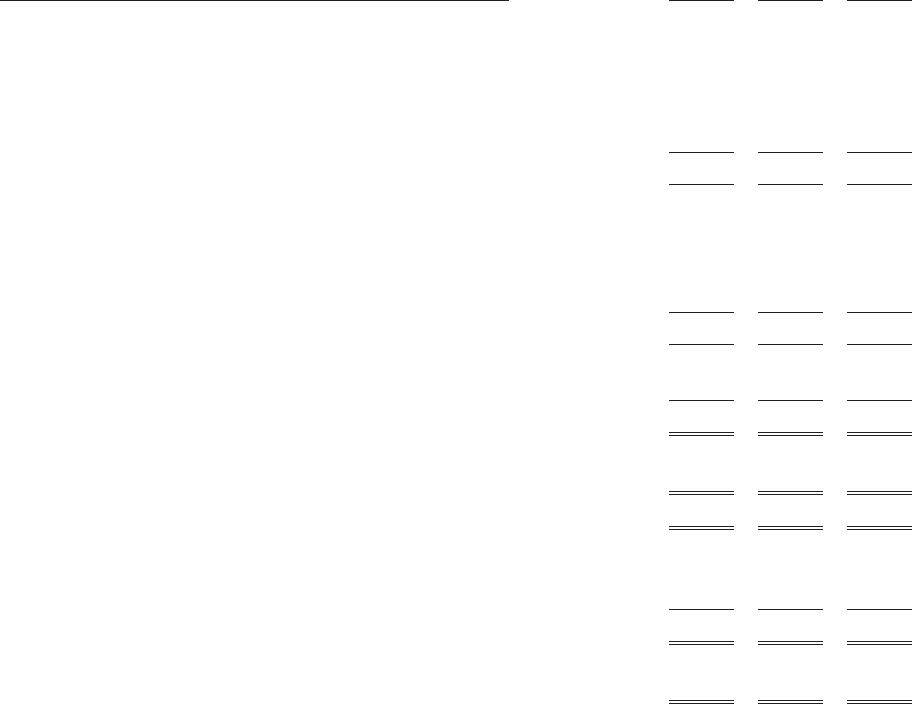

Consolidated Results of Operations

(for the year ended December 31, in millions except per share amounts) 2009 2008 2007

Revenues

Premiums .............................................. $21,418 $21,579 $21,470

Net investment income..................................... 2,776 2,792 3,761

Fee income ............................................. 306 390 508

Net realized investment gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . 17 (415) 154

Other revenues .......................................... 163 131 124

Total revenues ........................................ 24,680 24,477 26,017

Claims and expenses

Claims and claim adjustment expenses . . . . . . . . . . . . . . . . . . . . . . . . . . 12,408 12,993 12,397

Amortization of deferred acquisition costs . . . . . . . . . . . . . . . . . . . . . . . 3,813 3,880 3,706

General and administrative expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,366 3,518 3,352

Interest expense.......................................... 382 370 346

Total claims and expenses ............................... 19,969 20,761 19,801

Income before income taxes ................................ 4,711 3,716 6,216

Income tax expense ....................................... 1,089 792 1,615

Net income ............................................ $ 3,622 $ 2,924 $ 4,601

Net income per share

Basic ................................................ $ 6.38 $ 4.87 $ 7.00

Diluted .............................................. $ 6.33 $ 4.81 $ 6.85

GAAP combined ratio

Loss and loss adjustment expense ratio . . . . . . . . . . . . . . . . . . . . . . . 57.3% 59.4% 56.6%

Underwriting expense ratio ................................ 31.9 32.5 30.8

GAAP combined ratio .................................. 89.2% 91.9% 87.4%

Incremental impact of direct to consumer initiative on GAAP

combined ratio ...................................... 0.5% 0.2% —%

The following discussions of the Company’s net income and segment operating income are

presented on an after-tax basis. Discussions of the components of net income and segment operating

income are presented on a pretax basis, unless otherwise noted. Discussions of earnings per common

share are presented on a diluted basis.

Overview

Net income per diluted share of $6.33 in 2009 grew by 32% over net income per diluted share of

$4.81 on 2008. Net income of $3.62 billion in 2009 was 24% higher than 2008 net income of

$2.92 billion. The higher rate of growth in per share income compared with growth in income reflected

the impact of the Company’s significant common share repurchases. The increase in net income in 2009

was driven by declines in the cost of catastrophes. In addition, the increase reflected net realized

investment gains (versus net realized investment losses in 2008), lower non-catastrophe weather-related

losses and fewer large property losses, partially offset by reductions in underwriting margins related to

pricing and loss cost trends, a decline in net favorable prior year reserve development and lower fee

income. The cost of catastrophes in 2009 totaled $457 million, compared with $1.41 billion in 2008. The

2008 total was principally comprised of $1.26 billion of claims and claim adjustment expenses and

$141 million of property windpool assessments that were included in general and administrative

73