Travelers 2009 Annual Report Download - page 119

Download and view the complete annual report

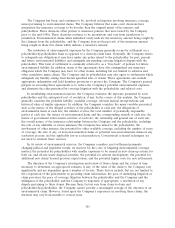

Please find page 119 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company makes investments in residential collateralized mortgage obligations (CMOs) that

typically have high credit quality, offer good liquidity and are expected to provide an advantage in yield

compared to U.S. Treasury securities. The Company’s investment strategy is to purchase CMO tranches

which offer the most favorable return given the risks involved. One significant risk evaluated is

prepayment sensitivity. While prepayment risk (either shortening or lengthening of duration) and its

effect on total return cannot be fully controlled, particularly when interest rates move dramatically, the

investment process generally favors securities that control this risk within expected interest rate ranges.

The Company does invest in other types of CMO tranches if a careful assessment indicates a favorable

risk/return tradeoff. The Company does not purchase residual interests in CMOs.

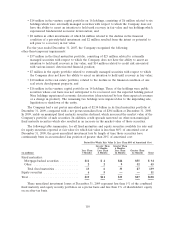

At December 31, 2009 and 2008, the Company held CMOs classified as available for sale with a

fair value of $2.58 billion and $2.84 billion, respectively (in addition to the CMBS securities of

$714 million and $766 million, respectively, described above). Approximately 37% and 35% of the

Company’s CMO holdings are guaranteed by or fully collateralized by securities issued by GNMA,

FNMA or FHLMC at December 31, 2009 and 2008, respectively. In addition, at December 31, 2009

and 2008, the Company held $2.63 billion and $3.22 billion, respectively, of GNMA, FNMA, FHLMC

(excluding FHA project loans which are included with CMBS) mortgage-backed pass-through securities

classified as available for sale. The average credit rating of all of the above securities was ‘‘Aa1’’ at

December 31, 2009, and ‘‘Aaa’’ at December 31, 2008.

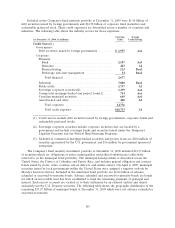

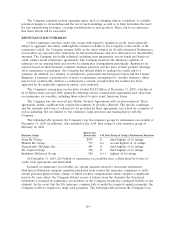

The Company’s fixed maturity investment portfolio at December 31, 2009 and 2008 included asset-

backed securities collateralized by sub-prime mortgages and collateralized mortgage obligations backed

by alternative documentation mortgages with a collective fair value of $270 million and $206 million,

respectively (comprising approximately 0.4% and 0.3% of the Company’s total fixed maturity

investments at December 31, 2009 and 2008, respectively). The disruption in secondary investment

markets for mortgage-backed securities provided the Company with the opportunity to selectively

acquire additional asset-backed securities collateralized by sub-prime mortgages at discounted prices.

The Company purchased $74 million and $47 million of such securities in the years ended

December 31, 2009 and 2008, respectively. The Company defines sub-prime mortgage-backed securities

as investments in which the underlying loans primarily exhibit one or more of the following

characteristics: low FICO scores, above-prime interest rates, high loan-to-value ratios or high

debt-to-income ratios. Alternative documentation securitizations are those in which the underlying loans

primarily meet the government-sponsored entity’s requirements for credit score but do not meet the

government-sponsored entity’s guidelines for documentation, property type, debt and loan-to-value

ratios. The average credit rating on these securities and obligations held by the Company was ‘‘A3’’ and

‘‘Aa2’’ at December 31, 2009 and 2008, respectively. Approximately $114 million of the Company’s

asset-backed securities collateralized by sub-prime and alternative documentation mortgages were

downgraded in 2009. An additional $39 million of such securities were placed on credit watch during

2009. Approximately $81 million of the Company’s asset-backed securities collateralized by sub-prime

and alternative documentation mortgages were downgraded in 2008.

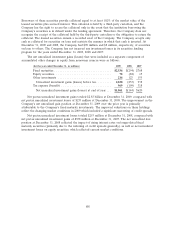

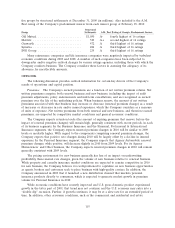

The Company’s real estate investments include warehouses and office buildings and other

commercial land and properties that are directly owned. The Company’s other investments are

primarily comprised of private equity limited partnerships, hedge funds, real estate partnerships, joint

ventures, mortgage loans, venture capital (through direct ownership and limited partnerships) and

trading securities, which are subject to more volatility than the Company’s fixed maturity investments.

While these asset classes have historically provided a higher return than fixed maturities, in 2009 and

2008 the returns were significantly lower than in prior periods and, in the aggregate, produced negative

investment income, reflecting market conditions. At December 31, 2009 and 2008, the carrying value of

the Company’s other investments was $2.95 billion and $3.04 billion, respectively.

The Company has engaged in securities lending activities from which it generates net investment

income from the lending of certain of its investments to other institutions for short periods of time.

107