Travelers 2009 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

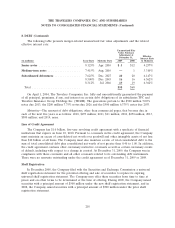

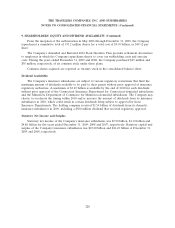

8. DEBT

Debt outstanding was as follows:

(at December 31, in millions) 2009 2008

Short-term:

Commercial paper ................................................. $ 100 $ 100

8.125% Senior notes due April 15, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 250 —

7.415% Medium-term notes due August 23, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 —

7.81% Private placement notes due September 16, 2010 and 2009 . . . . . . . . . . . . . . . 22

Zero coupon convertible notes, effective yield 4.17%, due March 3, 2009 . . . . . . . . . . —140

Total short-term debt ............................................. 373 242

Long-term:

8.125% Senior notes due April 15, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —250

7.415% Medium-term notes due August 23, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . —21

7.22% Real estate non-recourse debt due September 1, 2011 . . . . . . . . . . . . . . . . . . 99

7.81% Private placement notes due on various dates through 2011 . . . . . . . . . . . . . . 24

5.375% Senior notes due June 15, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 250 250

5.00% Senior notes due March 15, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500 500

5.50% Senior notes due December 1, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400 400

6.25% Senior notes due June 20, 2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400 400

5.75% Senior notes due December 15, 2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 450 450

5.80% Senior notes due May 15, 2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500 500

5.90% Senior notes due June 2, 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500 —

7.75% Senior notes due April 15, 2026 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200 200

7.625% Junior subordinated debentures due December 15, 2027 . . . . . . . . . . . . . . . . 125 125

6.375% Senior notes due March 15, 2033 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500 500

6.75% Senior notes due June 20, 2036 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400 400

6.25% Senior notes due June 15, 2037 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 800 800

8.50% Junior subordinated debentures due December 15, 2045 . . . . . . . . . . . . . . . . . 56 56

8.312% Junior subordinated debentures due July 1, 2046 . . . . . . . . . . . . . . . . . . . . . 73 73

6.25% Fixed-to-floating rate junior subordinated debentures due March 15, 2067 . . . . 1,000 1,000

Total long-term debt .............................................. 6,165 5,938

Total debt principal............................................... 6,538 6,180

Unamortized fair value adjustment ..................................... 58 68

Unamortized debt issuance costs....................................... (69) (67)

Total debt...................................................... $6,527 $6,181

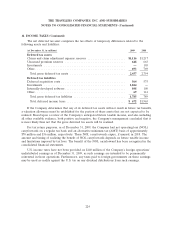

2009 Debt Issuance—On June 2, 2009, the Company issued $500 million aggregate principal

amount of 5.90% senior notes that will mature on June 2, 2019. The net proceeds of the issuance, after

original issuance discount and the deduction of underwriting expenses and commissions and other

expenses, totaled approximately $494 million. Interest on the senior notes is payable semi-annually in

arrears on June 2 and December 2 of each year. The senior notes are redeemable in whole at any time

or in part from time to time, at the Company’s option, at a redemption price equal to the greater of

(a) 100% of the principal amount of senior notes to be redeemed or (b) the sum of the present values

215