Travelers 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

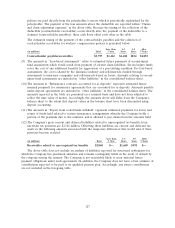

time before final claim resolution, the greater the exposure to estimation risks and hence the greater

the estimation uncertainty.

A major component of the claim tail is the reporting lag. The reporting lag, which is the time

between the event triggering a claim and the reporting of the claim to the insurer, makes estimating

IBNR inherently more uncertain. In addition, the greater the reporting lag, the greater the proportion

of IBNR to the total claim liability for the product line. Writing new products with material reporting

lags can result in adding several years worth of IBNR claim exposure before the reporting lag exposure

becomes clearly observable, thereby increasing the risk associated with pricing and reserving such

products. The most extreme example of claim liabilities with long reporting lags are asbestos claims.

For some lines, the impact of large individual claims can be material to the analysis. These lines

are generally referred to as being ‘‘low frequency/high severity,’’ while lines without this ‘‘large claim’’

sensitivity are referred to as ‘‘high frequency/low severity.’’ Estimates of claim liabilities for low

frequency/high severity lines can be sensitive to the impact of a small number of potentially large

claims. As a result, the role of judgment is much greater for these reserve estimates. In contrast, for

high frequency/low severity lines the impact of individual claims is relatively minor and the range of

reasonable reserve estimates is narrower and more stable.

Claim complexity can also greatly affect the estimation process by impacting the number of

assumptions needed to produce the estimate, the potential stability of the underlying data and claim

process, and the ability to gain an understanding of the data. Product lines with greater claim

complexity, such as for certain surety and construction exposures, have inherently greater estimation

uncertainty.

Actuaries have to exercise a considerable degree of judgment in the evaluation of all these factors

in their analysis of reserves. The human element in the application of actuarial judgment is unavoidable

when faced with material uncertainty. Different actuaries may choose different assumptions when faced

with such uncertainty, based on their individual backgrounds, professional experiences and areas of

focus. Hence, the estimates selected by the various actuaries may differ materially from each other.

Lastly, significant structural changes to the available data, product mix or organization can also

materially impact the reserve estimation process. Events such as mergers increase the inherent

uncertainty of reserve estimates for a period of time, until stable trends re-establish themselves within

the new organization.

Risk factors

The major causes of material uncertainty (‘‘risk factors’’) generally will vary for each product line,

as well as for each separately analyzed component of the product line. In a few cases, such risk factors

are explicit assumptions of the estimation method, but in most cases, they are implicit. For example, a

method may explicitly assume that a certain percentage of claims will close each year, but will implicitly

assume that the legal interpretation of existing contract language will remain unchanged. Actual results

will likely vary from expectations for each of these assumptions, causing actual paid losses, as claims

are settled in the future, to be different in amount than the reserves being estimated currently.

Some risk factors will affect more than one product line. Examples include changes in claim

department practices, changes in settlement patterns, regulatory and legislative actions, court actions,

timeliness of claim reporting, state mix of claimants and degree of claimant fraud. The extent of the

impact of a risk factor will also vary by components within a product line. Individual risk factors are

also subject to interactions with other risk factors within product line components.

The effect of a particular risk factor on estimates of claim liabilities cannot be isolated in most

cases. For example, estimates of potential claim settlements may be impacted by the risk associated

132