Travelers 2009 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

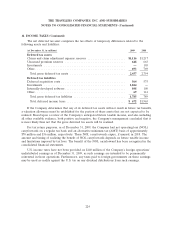

8. DEBT (Continued)

of the remaining scheduled payments of principal and interest on the senior notes to be redeemed

(exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a

semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the then current

Treasury rate (as defined) plus 35 basis points for the senior notes.

2009 Debt Maturity—On March 3, 2009, the Company’s zero coupon convertible notes with an

effective yield of 4.17% and a remaining principal balance of $141 million matured and were fully paid.

2008 Debt Issuance—In May 2008, the Company issued $500 million aggregate principal amount of

5.80% senior notes that will mature on May 15, 2018. The net proceeds of the issuance, after original

issuance discount and the deduction of underwriting expenses and commissions and other expenses,

totaled approximately $496 million. Interest on the senior notes is payable semi-annually on May 15

and November 15. The senior notes are redeemable in whole at any time or in part from time to time,

at the Company’s option, at a redemption price equal to the greater of (a) 100% of the principal

amount of senior notes to be redeemed or (b) the sum of the present values of the remaining

scheduled payments of principal and interest on the senior notes to be redeemed (exclusive of interest

accrued to the date of redemption) discounted to the date of redemption on a semi-annual basis

(assuming a 360-day year consisting of twelve 30-day months) at the then current Treasury rate plus 30

basis points for the senior notes.

2008 Debt Maturities—In March 2008, the Company’s $400 million, 3.75% senior notes matured

and were fully paid. In December 2008, medium-term notes with a par value of $149 million and an

interest rate of 6.38% matured and were fully paid.

Description of Debt

Commercial Paper—The Company maintains an $800 million commercial paper program with

$1 billion of back-up liquidity, consisting entirely of a bank credit agreement that expires on June 10,

2010. (See ‘‘Line of Credit Agreement’’ discussion that follows). Interest rates on commercial paper

issued in 2009 ranged from 0.2% to 0.7%, and in 2008 ranged from 0.5% to 4.6%.

Medium-Term Notes—The two medium-term notes outstanding at December 31, 2009 each bear an

interest rate of 7.415% and mature in August 2010. No medium-term notes matured in 2009. During

2008, medium-term notes having a par value of $149 million matured.

Senior Notes—The Company’s various senior debt issues are unsecured obligations that rank

equally with one another. Interest payments are made semi-annually. The Company generally may

redeem some or all of the notes prior to maturity in accordance with terms unique to each debt

instrument.

Junior Subordinated Debentures—The Company’s $1 billion aggregate principal amount of 6.25%

fixed-to-floating rate debentures bear interest at an annual rate of 6.25% from the date of issuance to,

but excluding, March 15, 2017, payable semi-annually in arrears on March 15 and September 15. From

and including March 15, 2017, the debentures will bear interest at an annual rate equal to three-month

LIBOR plus 2.215%, payable quarterly on March 15, June 15, September 15 and December 15 of each

year. The Company has the right, on one or more occasions, to defer the payment of interest on the

debentures. The Company will not be required to settle deferred interest until it has deferred interest

for five consecutive years or, if earlier, made a payment of current interest during a deferral period.

216