Travelers 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

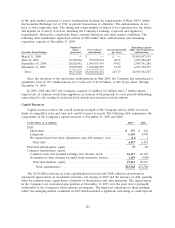

The following table provides a reconciliation of total capitalization excluding net unrealized gain

(loss) on investments to total capitalization presented in the foregoing table.

(at December 31, dollars in millions) 2009 2008

Total capitalization excluding net unrealized gain (loss) on investments . . . . . . . . . $32,081 $31,644

Net unrealized gain (loss) on investments, net of taxes . . . . . . . . . . . . . . . . . . . . . 1,861 (144)

Total capitalization.............................................. $33,942 $31,500

Debt-to-total capital ratio......................................... 19.2% 19.6%

Debt-to-total capital ratio excluding net unrealized gain (loss) on investments . . . 20.3% 19.5%

The debt-to-total capital ratio excluding net unrealized gain (loss) on investments is calculated by

dividing (a) debt by (b) total capitalization excluding net unrealized investment gain (loss) on

investments, net of taxes. Net unrealized investment gains and losses can be significantly impacted by

both discretionary and other economic factors and are not necessarily indicative of operating trends.

Accordingly, in the opinion of the Company’s management, the debt-to-total capital ratio calculated on

this basis provides another useful metric for investors to understand the Company’s financial leverage

position. The Company’s debt-to-total capital ratio of 20.3% at December 31, 2009 calculated on this

basis approximated its targeted level.

Line of Credit Agreement. The Company has a $1.0 billion, five-year revolving credit agreement

(the ‘‘credit agreement’’) with a syndicate of financial institutions that expires on June 10, 2010.

Pursuant to covenants in the credit agreement, the Company must maintain an excess of consolidated

net worth over goodwill and other intangible assets of not less than $10 billion at all times. The

Company must also maintain a ratio of total consolidated debt to the sum of total consolidated debt

plus consolidated net worth of not greater than 0.40 to 1.00. In addition, the credit agreement contains

other customary restrictive covenants as well as certain customary events of default, including with

respect to a change in control. At December 31, 2009, the Company was in compliance with these

covenants and all other covenants related to its outstanding debt instruments. There was no amount

outstanding under the credit agreement as of December 31, 2009. The Company is evaluating its

options with regard to the forthcoming expiration of the credit agreement. The credit agreement

provides back-up liquidity for the Company’s $800 million commercial paper program, of which

$100 million was outstanding at December 31, 2009.

In December 2008, the Company filed with the Securities and Exchange Commission a universal

shelf registration statement for the potential offering and sale of securities to replace its expiring

universal shelf registration statement. The Company may offer these securities from time to time at

prices and on other terms to be determined at the time of offering. During 2009, the Company issued

securities with a principal amount of $500 million under the new shelf registration statement, and in

2008, the Company issued securities with a principal amount of $500 million under the prior shelf

registration statement.

Share Repurchase Authorization. At December 31, 2009, the Company had $6.51 billion of

capacity remaining under its share repurchase authorization approved by the board of directors.

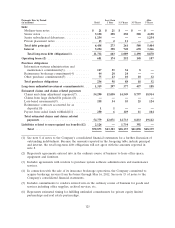

Contractual Obligations

The following table summarizes, as of December 31, 2009, the Company’s future payments under

contractual obligations and estimated claims and claims related payments. The table excludes

short-term obligations and includes only liabilities at December 31, 2009 that are expected to be settled

in cash.

123