Travelers 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

particularly the case with policyholders in bankruptcy where negotiations often involve a large number

of claimants and other parties and require court approval to be effective. As part of its continuing

analysis of asbestos and environmental reserves, the Company continues to study the implications of

these and other developments. (Also, see ‘‘Part I—Item 3, Legal Proceedings’’).

Because of the uncertainties set forth above, additional liabilities may arise for amounts in excess

of the current related reserves. In addition, the Company’s estimate of claims and claim adjustment

expenses may change. These additional liabilities or increases in estimates, or a range of either, cannot

now be reasonably estimated and could result in income statement charges that could be material to

the Company’s operating results in future periods.

INVESTMENT PORTFOLIO

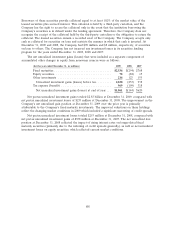

The Company’s invested assets at December 31, 2009 totaled $74.97 billion, of which 94% was

invested in fixed maturity and short-term investments, 1% in equity securities, 1% in real estate and

4% in other investments. Because the primary purpose of the investment portfolio is to fund future

claims payments, the Company employs a conservative investment philosophy. A significant majority of

funds available for investment are deployed in a widely diversified portfolio of high quality, liquid

taxable U.S. government, tax-exempt U.S. municipal bonds, and taxable corporate and U.S. agency

mortgage-backed bonds.

The Company’s fixed maturity portfolio at December 31, 2009 totaled $65.85 billion. The Company

closely monitors the duration of its fixed maturity investments, and investment purchases and sales are

executed with the objective of having adequate funds available to satisfy the Company’s insurance and

debt obligations. The weighted average credit quality of the Company’s fixed maturity portfolio, both

including and excluding U.S. Treasury securities, was ‘‘Aa2’’ at December 31, 2009 and ‘‘Aa1’’ at

December 31, 2008. The slight decline in the Company’s average credit quality rating was due to the

downgrading of a monoline bond insurer during the second quarter of 2009 and the downgrading of

non-agency mortgage-backed securities. Below investment grade securities represented 2.7% and 2.0%

of the total fixed maturity investment portfolio at December 31, 2009 and 2008, respectively. The

downgrading of non-agency mortgage backed securities and an increase in the fair value of those and

other below investment grade securities also resulted in an increase to our below investment grade

securities. The average effective duration of fixed maturities and short-term securities was 3.9 (4.2

excluding short-term securities) at December 31, 2009 and 4.2 (4.6 excluding short-term securities) at

December 31, 2008. The decline in duration resulted from the impact of declining market yields on

existing holdings of municipal bonds and mortgage-backed securities (which impact the assumptions

related to optional pre-payments and the related estimate of effective duration for callable securities),

and the purchase of shorter-term fixed maturities during the second half of 2009.

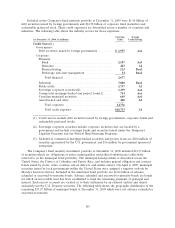

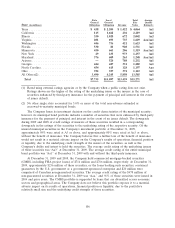

The following table sets forth the Company’s combined fixed maturity investment portfolio rated

using external ratings agencies or by the Company when a public rating does not exist:

Carrying Percent of Total

(at December 31, 2009, in millions) Value Carrying Value

Quality Rating:

Aaa ....................................... $28,093 42.7%

Aa ........................................ 24,861 37.8

A......................................... 7,000 10.6

Baa ....................................... 4,091 6.2

Total investment grade.......................... 64,045 97.3

Below investment grade......................... 1,802 2.7

Total fixed maturity investments . . . . . . . . . . . . . . . . . . . $65,847 100.0%

104