Travelers 2009 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

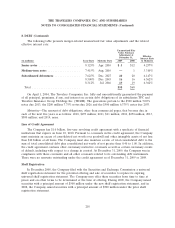

7. INSURANCE CLAIM RESERVES (Continued)

Net asbestos losses paid in 2009, 2008 and 2007 were $341 million, $658 million and $317 million,

respectively. (Asbestos payments in 2008 included the Company’s one-time net payment of $365 million

associated with the settlement of the ACandS, Inc. matter). Approximately 41%, 59% and 20% of total

net paid losses in 2009, 2008 and 2007, respectively, related to policyholders with whom the Company

had entered into settlement agreements limiting the Company’s liability.

The Company recorded a $185 million increase in the Company’s asbestos reserves in 2009,

primarily driven by a slight increase in the Company’s assumption for projected defense costs related to

a broad range of policyholders. Overall, the company’s assessment of the underlying asbestos

environment did not change significantly from recent periods. The Company recorded a $70 million

pretax increase to asbestos reserves in 2008, which was driven by a change in the estimated costs

associated with litigating asbestos coverage matters and a change in estimated losses for certain

individual policyholders. The Company recorded no asbestos reserve additions in 2007.

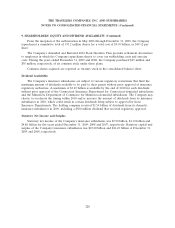

Environmental Reserves. In establishing environmental reserves, the Company evaluates the

exposure presented by each policyholder and the anticipated cost of resolution, if any. In the course of

this analysis, the Company generally considers the probable liability, available coverage, relevant judicial

interpretations and historical value of similar exposures. In addition, the Company considers the many

variables presented, such as the nature of the alleged activities of the policyholder at each site; the

allegations of environmental harm at each site; the number of sites; the total number of potentially

responsible parties at each site; the nature of environmental harm and the corresponding remedy at

each site; the nature of government enforcement activities at each site; the ownership and general use

of each site; the overall nature of the insurance relationship between the Company and the

policyholder, including the role of any umbrella or excess insurance the Company has issued to the

policyholder; the involvement of other insurers; the potential for other available coverage, including the

number of years of coverage; the role, if any, of non-environmental claims or potential

non-environmental claims in any resolution process; and the applicable law in each jurisdiction.

Conventional actuarial techniques are not used to estimate these reserves.

The Company continues to receive notices from policyholders tendering claims for the first time.

These policyholders generally present smaller exposures, have fewer sites and are lower tier defendants.

Further, in many instances clean-up costs have been reduced because regulatory agencies are willing to

accept risk-based site analyses and more efficient clean-up technologies. In recent years, the Company

had experienced a decline in both the number of new policyholders tendering claims for the first time

and the number of pending lawsuits between the Company and its policyholders pertaining to coverage

for environmental claims. However, during 2009, the Company experienced an increase in the number

of policyholders tendering claims for the first time and in the number of pending environmental related

coverage actions. In addition, the Company experienced upward development in the expected defense

and settlement costs for certain of its pending policyholders. As a result, the Company increased its net

environmental reserves by $70 million in the second quarter of 2009. In 2008, the Company increased

its environmental reserves by $85 million as a result of upward development in the anticipated defense

and settlement costs for certain of its pending policyholders. In 2007, the Company increased its

environmental reserves by $185 million primarily in response to the moderation in the rate of decline in

both the number of new policyholders tendering claims for the first time and the number of pending

lawsuits between the Company and its policyholders pertaining to coverage for environmental claims.

212