Travelers 2009 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

unfunded pension obligations, litigation or other contingent claims, the treatment of intercompany

claims and the likely outcome with respect to inter-creditor conflicts.

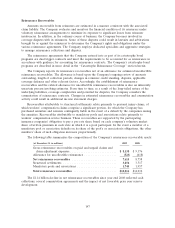

For structured fixed maturity securities (primarily residential and commercial mortgage-backed

securities, collateralized mortgage obligations and pass-through securities), the Company estimates the

present value of the security by projecting future cash flows of the assets underlying the securitization,

allocating the flows to the various tranches based on the structure of the securitization, and

determining the present value of the cash flows using the effective yield of the security at the date of

acquisition (or the most recent implied rate used to accrete the security if the implied rate has changed

as a result of a previous impairment or changes in expected cash flows). The Company incorporates

levels of delinquencies, defaults and severities as well as credit attributes of the remaining assets in the

securitization, along with other economic data, to arrive at its best estimate of the parameters applied

to the assets underlying the securitization. In order to project cash flows, the following assumptions are

applied to the assets underlying the securitization: (1) voluntary prepayment rates, (2) default rates and

(3) loss severity. The key assumptions made for the Prime, Alt-A and Sub-Prime mortgage-backed

securities at December 31, 2009 were as follows:

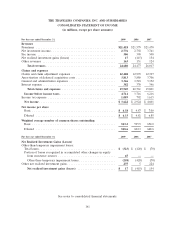

(at December 31, 2009) Prime Alt-A Sub-Prime

Voluntary prepayment rates . . . . . . . . . . . . . . . . . . . . . . . . . 2% - 15% 1% - 8% 1% - 6%

Percentage of remaining pool liquidated due to defaults . . . . 5% - 55% 23% - 75% 31% - 90%

Loss severity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35% - 60% 50% - 75% 70% - 80%

Changes in Intent to Sell Temporarily Impaired Assets

The Company may, from time to time, sell invested assets subsequent to the balance sheet date

that it did not intend to sell at the balance sheet date. Conversely, the Company may not sell invested

assets that it asserted that it intended to sell at the balance sheet date. Such changes in intent are

generally due to events occurring subsequent to the balance sheet date. The types of events that may

result in a change in intent include, but are not limited to, significant changes in the economic facts

and circumstances related to the invested asset (e.g., a downgrade or upgrade from a rating agency),

significant unforeseen changes in liquidity needs, or changes in tax laws or the regulatory environment.

Real Estate Investments

On at least an annual basis, the Company obtains independent appraisals for substantially all of its

real estate investments. In addition, the carrying value of all real estate property is reviewed for

impairment on a quarterly basis or when events or changes in circumstances indicate that the carrying

amount may not be recoverable. The review for impairment considers the valuation from the

independent appraisal, when applicable, and incorporates an estimate of the undiscounted cash flows

expected to result from the use and eventual disposition of the real estate property. An impairment loss

is recognized if the expected future undiscounted cash flows are less than the carrying value of the real

estate property. The impairment loss is the amount by which the carrying amount exceeds fair value.

Other Investments

Investments in Private Equity Limited Partnerships, Hedge Funds and Real Estate Partnerships

The Company reviews these investments for impairment no less frequently than quarterly and

monitors the performance throughout the year through discussions with the managers/general partners.

If the Company becomes aware of an impairment of a partnership’s investments at the balance sheet

date prior to receiving the partnership’s financial statements, it will recognize an impairment by

recording a reduction in the carrying value of the partnership with a corresponding charge to net

investment income.

153