Travelers 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.environment and employment rates, may continue to be weak. If weak economic conditions persist or

deteriorate, low levels of economic activity could impact exposure changes at renewal and our ability to

write business at acceptable rates. Additionally, such low levels of economic activity could adversely

impact audit premium adjustments, policy endorsements and mid-term cancellations after policies are

written. All of the foregoing, in turn, could adversely impact net written premiums in 2010. Since

earned premiums lag net written premiums, earned premiums could be adversely impacted in 2010 and

into 2011.

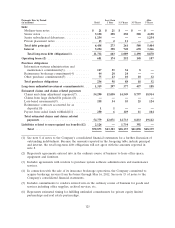

Underwriting Gain/Loss. The anticipated impact of competitive market conditions and general

economic conditions on the Company’s earned premiums, as discussed above, coupled with an expected

modest increase in loss costs, will likely result in modestly reduced underwriting profitability during

2010, as compared with 2009. In addition, the Company’s direct to consumer initiative in the Personal

Insurance segment, discussed above, while intended to enhance the Company’s long-term ability to

compete successfully in a consumer-driven marketplace, is expected to remain unprofitable for a

number of years as this book of business grows and matures.

In recent periods, the Company has experienced net favorable prior year reserve development,

driven by better than expected loss experience in all of the Company’s segments for prior loss years. If

better than expected loss experience continues, the Company may recognize additional net favorable

prior year reserve development in 2010. However, better than expected loss experience may not

continue or may reverse, in which case the Company may recognize no favorable prior year reserve

development or unfavorable prior year reserve development in future periods. The ongoing review of

prior year claim and claim adjustment expense reserves, or other changes in current period

circumstances, may result in the Company revising current year loss estimates upward or downward in

future periods.

Catastrophe losses are inherently unpredictable from year to year, and the Company’s results of

operations would be adversely impacted by a significant increase in such losses in 2010.

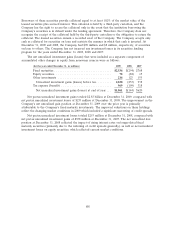

Investments. The Company expects to continue to focus its investment strategy on maintaining a

high-quality investment portfolio and a relatively low average effective duration. The Company’s

invested assets at December 31, 2009 totaled $74.97 billion, of which 94% was invested in fixed

maturity and short-term securities, with the remaining 6% invested in equity securities, real estate,

private equity limited partnerships, hedge funds, and real estate partnerships.

Net investment income is a material contributor to the Company’s results of operations. While

investment returns are difficult to predict and inherently uncertain, in 2010 the Company expects

investment returns for its fixed maturity investment portfolio to be generally consistent with recent

periods, and returns for its short-term and non-fixed maturity investment portfolios to remain

challenged. Short-term interest rates are expected to remain at or near historically low levels. The

Company expects investment income in its non-fixed maturity investment portfolio to improve from

2009 levels, which were negative. However, if general economic conditions and/or capital market

conditions deteriorate in 2010, the Company could also experience a reduction in net investment

income and/or significant realized investment losses, including impairments.

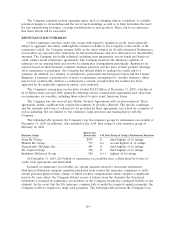

Capital Position. The Company believes it has a strong capital position and expects to continue its

common share repurchase program in 2010 as part of its continuing efforts to maximize shareholder

value. During 2010, the Company expects to repurchase between $3.5 billion and $4.0 billion of its

common shares under its share repurchase authorization. The actual amount of share repurchases may

be materially less and will depend on a variety of factors, including the Company’s earnings, corporate

and regulatory requirements, share price, catastrophe losses, strategic initiatives and other market

conditions.

The Company had a net after-tax unrealized investment gain of $1.67 billion in its fixed maturity

investment portfolio at December 31, 2009. While the Company does not attempt to predict future

116