Travelers 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company regularly reviews emerging issues, such as changing climate conditions, to consider

potential changes to its modeling and the use of such modeling, as well as to help determine the need

for new underwriting strategies, coverage modifications or new products. There can be no assurance

that these efforts will be successful.

REINSURANCE RECOVERABLES

Ceded reinsurance involves credit risk, except with regard to mandatory pools, and is generally

subject to aggregate loss limits. Although the reinsurer is liable to the Company to the extent of the

reinsurance ceded, the Company remains liable as the direct insurer on all risks reinsured. Reinsurance

recoverables are reported after reductions for known insolvencies and after allowances for uncollectible

amounts. The Company also holds collateral, including trust agreements, escrow funds and letters of

credit, under certain reinsurance agreements. The Company monitors the financial condition of

reinsurers on an ongoing basis and reviews its reinsurance arrangements periodically. Reinsurers are

selected based on their financial condition, business practices and the price of their product offerings.

After reinsurance is purchased, the Company has limited ability to manage the credit risk to a

reinsurer. In addition, in a number of jurisdictions, particularly the European Union and the United

Kingdom, a reinsurer is permitted to transfer a reinsurance arrangement to another reinsurer, which

may be less creditworthy, without a counterparty’s consent, provided that the transfer has been

approved by the applicable regulatory and/or court authority.

The Company’s reinsurance recoverables totaled $12.82 billion at December 31, 2009, a decline of

$1.42 billion from year-end 2008, primarily reflecting various commutation agreements and collections

on reinsurance recoverables, including those related to prior years’ hurricane losses.

The Company has also entered into Master Security Agreements with certain reinsurers. These

agreements define conditions that require the reinsurer to provide collateral. The specific conditions

and the amounts and form of collateral to be provided by these agreements vary based on a number of

factors including, but not limited to, the reinsurers’ legal structure and trading history with the

Company.

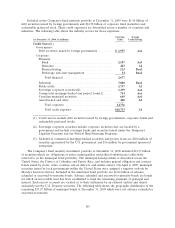

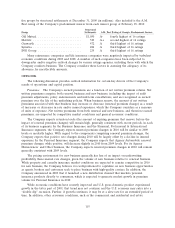

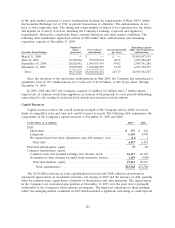

The following table presents the Company’s top five reinsurer groups by reinsurance recoverable at

December 31, 2009 (in millions). Also included is the A.M. Best rating of each reinsurer group at

February 18, 2010:

Reinsurance

Reinsurer Group Recoverable A.M. Best Rating of Group’s Predominant Reinsurer

Swiss Re Group . . . . . . . . . . . . . . . . . . . . . . $895 A third highest of 16 ratings

Munich Re Group . . . . . . . . . . . . . . . . . . . . 779 A+ second highest of 16 ratings

Transatlantic Holdings, Inc. . . . . . . . . . . . . . 485 A third highest of 16 ratings

XL Capital Group . . . . . . . . . . . . . . . . . . . . 398 A third highest of 16 ratings

Berkshire Hathaway Group . . . . . . . . . . . . . 386 A++ highest of 16 ratings

At December 31, 2009, $2.4 billion of reinsurance recoverables were collateralized by letters of

credit, trust agreements and funds held.

Included in reinsurance recoverables are certain amounts related to structured settlements.

Structured settlements comprise annuities purchased from various life insurance companies to settle

certain personal physical injury claims, of which workers’ compensation claims comprise a significant

portion. In cases where the Company did not receive a release from the claimant, the structured

settlement is included in reinsurance recoverables as the Company retains the contingent liability to the

claimant. In the event that the life insurance company fails to make the required annuity payments, the

Company would be required to make such payments. The following table presents the Company’s top

114