Travelers 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

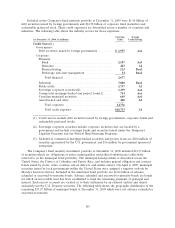

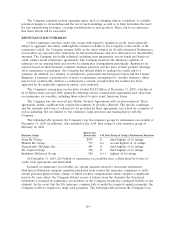

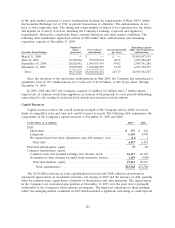

Percentage of

Common Equity(2)

Single Single

Likelihood of Exceedance Hurricane Earthquake

2.0% (1-in-50) ................................ 4% 2%

1.0% (1-in-100) ............................... 4% 2%

0.4% (1-in-250) ............................... 8% 4%

0.1% (1-in-1,000) .............................. 18% 9%

(1) An event that has, for example, a 2% likelihood of exceedance is sometimes described as

a ‘‘1-in-50 year event.’’ As noted above, however, the probabilities in the table represent

the likelihood of losses from a single event equaling or exceeding the indicated threshold

loss amount in a one-year timeframe, not over a multi-year timeframe. Also, because the

probabilities relate to a single event, the probabilities do not address the likelihood of

more than one event occurring in a particular period, and, therefore, the amounts do not

address potential aggregate catastrophe losses occurring in a one-year timeframe.

(2) The percentage of common equity is calculated by dividing (a) indicated loss amounts in

dollars by (b) total common equity excluding net unrealized investment gain (loss) on

investments, net of taxes. Net unrealized investment gains and losses can be significantly

impacted by both discretionary and other economic factors and are not necessarily

indicative of operating trends. Accordingly, in the opinion of the Company’s management,

the percentage of common equity calculated on this basis provides a useful metric for

investors to understand the potential impact of a single hurricane or single earthquake on

the Company’s financial position.

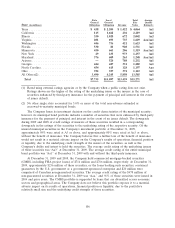

The threshold loss amounts in the tables above are net of reinsurance, after-tax and exclude loss

adjustment expense, which historically has been less than 10% of loss estimates. The above threshold

loss amounts reflect the most recent version of the modeling software. The amounts for hurricanes

reflect U.S. exposures and include property exposures (other than offshore energy and marine

exposures), property residual market exposures and an adjustment for certain non-property exposures.

The amounts for earthquakes reflect U.S. and Canadian exposures and include property exposures and

workers’ compensation exposures. The Company does not believe that the inclusion of hurricane or

earthquake losses arising from other geographical areas or other exposures would materially change the

estimated threshold loss amounts. This information in the tables is based on the Company’s in-force

portfolio and catastrophic reinsurance program as of December 31, 2009.

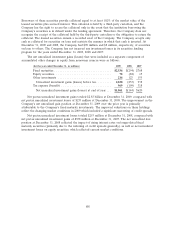

Catastrophe modeling requires a significant amount of judgment and a number of assumptions and

relies upon inputs based on experience, science, engineering and history. As a result, such models may

fail to account for risks that are outside the range of normal probability or that are otherwise

unforeseeable. Catastrophe modeling assumptions include, among others, the portion of purchased

reinsurance that is collectible after a catastrophic event, which may prove to be materially incorrect.

Consequently, catastrophe modeling estimates are subject to significant uncertainty. In the tables above,

the uncertainty associated with the estimated threshold loss amounts increases significantly as the

likelihood of exceedance decreases. In other words, in the case of a relatively more remote event

(e.g., 1-in-1,000), the estimated threshold loss amount is relatively less reliable. Actual losses from an

event could materially exceed the indicated threshold loss amount. In addition, more than one such

event could occur in any period.

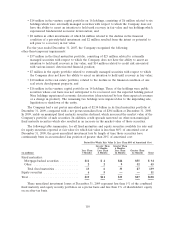

Moreover, the Company is exposed to the risk of material losses from other than property and

workers’ compensation coverages arising out of hurricanes and earthquakes, and it is exposed to

catastrophe losses from perils other than hurricanes and earthquakes, for example, floods, tornadoes

and acts of terrorism.

112