Travelers 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

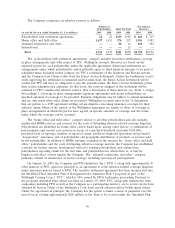

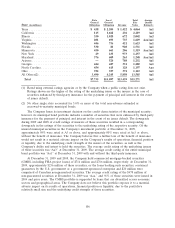

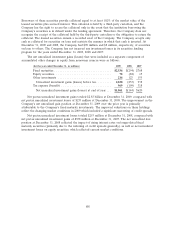

State Local Total Average

General General Fair Quality

State (in millions) Obligation Obligation Revenue Value Rating(1)

Texas................................. $ 438 $ 2,204 $ 1,422 $ 4,064 Aa1

California ............................. 115 1,668 436 2,219 Aa2

Illinois................................ 350 1,020 672 2,042 Aa2

Virginia............................... 201 693 735 1,629 Aaa/Aa1

Washington ............................ 446 756 421 1,623 Aa1

Florida ............................... 530 81 920 1,531 Aa1

Minnesota ............................. 450 663 206 1,319 Aaa/Aa1

New York ............................. 49 235 973 1,257 Aa1

Maryland.............................. 376 609 263 1,248 Aaa/Aa1

Arizona............................... — 524 708 1,232 Aa1

Georgia............................... 444 427 331 1,202 Aa1

North Carolina.......................... 454 615 128 1,197 Aaa

Ohio ................................. 392 357 374 1,123 Aa1

All Others(2)........................... 3,490 4,245 5,850 13,585 Aa1

Total ............................... $7,735 $14,097 $13,439 $35,271 Aa1

(1) Rated using external ratings agencies or by the Company when a public rating does not exist.

Ratings shown are the higher of the rating of the underlying issuer or the insurer in the case of

securities enhanced by third-party insurance for the payment of principal and interest in the event

of issuer default.

(2) No other single state accounted for 3.0% or more of the total non-advance-refunded or

escrowed-to-maturity municipal bonds.

The Company bases its investment decision on the credit characteristics of the municipal security;

however, its municipal bond portfolio includes a number of securities that were enhanced by third-party

insurance for the payment of principal and interest in the event of an issuer default. The downgrade

during 2009 and 2008 of credit ratings of insurers of these securities resulted in a corresponding

downgrade in the ratings of the securities to the underlying rating of the respective security. Of the

insured municipal securities in the Company’s investment portfolio at December 31, 2009,

approximately 98% were rated at A3 or above, and approximately 80% were rated at Aa3 or above,

without the benefit of insurance. The Company believes that a further loss of the benefit of insurance

would not result in a material adverse impact on the Company’s results of operations, financial position

or liquidity, due to the underlying credit strength of the issuers of the securities, as well as the

Company’s ability and intent to hold the securities. The average credit rating of the underlying issuers

of these securities was ‘‘Aa3’’ at December 31, 2009. The average credit rating of the entire municipal

bond portfolio was ‘‘Aa1’’ at December 31, 2009 with and without the third-party insurance.

At December 31, 2009 and 2008, the Company held commercial mortgage-backed securities

(CMBS, including FHA project loans) of $714 million and $766 million, respectively. At December 31,

2009, approximately $236 million of these securities, or the loans backing such securities, contained

guarantees by the U.S. government or a government-sponsored enterprise and $20 million were

comprised of Canadian non-guaranteed securities. The average credit rating of the $478 million of

non-guaranteed securities at December 31, 2009 was ‘‘Aaa,’’ and 91% of those securities were issued in

2004 and prior years. The CMBS portfolio is supported by loans that are diversified across economic

sectors and geographical areas. The Company does not believe this portfolio exposes it to a material

adverse impact on its results of operations, financial position or liquidity, due to the portfolio’s

relatively small size and the underlying credit strength of these securities.

106