Travelers 2009 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

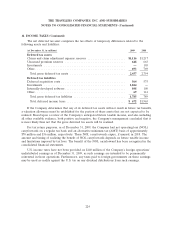

8. DEBT (Continued)

The Company may defer interest for up to ten consecutive years without giving rise to an event of

default. Deferred interest will accumulate additional interest at an annual rate equal to the annual

interest rate then applicable to the debentures.

The debentures carry a 60-year final maturity and a scheduled maturity date in year thirty. During

the 180-day period ending not more than 15 and not less than ten business days prior to the scheduled

maturity date, the Company is required to use commercially reasonable efforts to sell enough qualifying

capital securities, or at its option, common stock, qualifying warrants, mandatorily convertible preferred

stock, debt exchangeable for common equity or debt exchangeable for preferred equity to permit

repayment of the debentures at the scheduled maturity date. If any debentures remain outstanding

after the scheduled maturity date, the unpaid amount will remain outstanding until the Company has

raised sufficient proceeds from the sale of qualifying capital securities or, at its option, common stock,

qualifying warrants, mandatorily convertible preferred stock, debt exchangeable for common equity or

debt exchangeable for preferred equity to permit the repayment in full of the debentures. If there are

remaining debentures at the final maturity date, the Company is required to redeem the debentures

using any source of funds. Qualifying capital securities are securities (other than common stock,

qualifying warrants, mandatorily convertible preferred stock, debt exchangeable for common equity, and

debt exchangeable for preferred equity) which generally are treated by the ratings agencies as having

similar equity content to the debentures.

The Company can redeem the debentures at its option, in whole or in part, at any time on or after

March 15, 2017 at a redemption price of 100% of the principal amount being redeemed plus accrued

but unpaid interest. The Company can redeem the debentures at its option prior to March 15, 2017

(a) in whole at any time or in part from time to time or (b) in whole, but not in part, in the event of

certain tax or rating agency events relating to the debentures, at a redemption price equal to the

greater of 100% of the principal amount being redeemed and the applicable make-whole amount, in

each case plus any accrued and unpaid interest.

In connection with the offering of the debentures, the Company entered into a ‘‘replacement

capital covenant’’ for the benefit of holders of one or more designated series of the Company’s

indebtedness (which will initially be the 6.750% senior notes due 2036). Under the terms of the

replacement capital covenant, if the Company redeems the debentures at any time prior to March 15,

2047 it can only do so with the proceeds of securities that are treated by the rating agencies as having

similar equity content to the debentures.

The Company’s three other junior subordinated debenture instruments are all similar in nature to

each other. Three separate business trusts issued preferred securities to investors and used the proceeds

to purchase the Company’s subordinated debentures. Interest on each of the instruments is paid

semi-annually.

The Company’s consolidated balance sheet includes the debt instruments acquired in the merger,

which were recorded at fair value as of the acquisition date. The resulting fair value adjustment is

being amortized over the remaining life of the respective debt instruments using the effective-interest

method. The amortization of the fair value adjustment reduced interest expense by $11 million and

$15 million for the years ended December 31, 2009 and 2008, respectively.

217