Travelers 2009 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

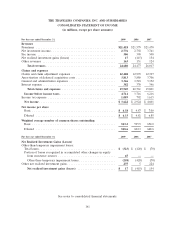

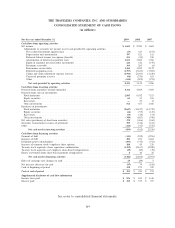

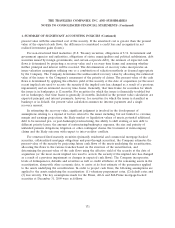

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

For the year ended December 31, 2009 2008 2007

Cash flows from operating activities

Net income...................................................... $ 3,622 $ 2,924 $ 4,601

Adjustments to reconcile net income to net cash provided by operating activities:

Net realized investment (gains) losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17) 415 (154)

Depreciation and amortization....................................... 797 821 811

Deferred federal income tax expense (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 213 (58) 230

Amortization of deferred acquisition costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,813 3,880 3,706

Equity in (income) loss from other investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . 126 312 (570)

Premiums receivable ............................................. 364 285 (4)

Reinsurance recoverables .......................................... 1,416 1,209 2,172

Deferred acquisition costs.......................................... (3,797) (3,845) (3,925)

Claims and claim adjustment expense reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,596) (2,033) (1,410)

Unearned premium reserves ........................................ (96) (270) 103

Other ...................................................... (614) (502) (274)

Net cash provided by operating activities ............................... 4,231 3,138 5,286

Cash flows from investing activities

Proceeds from maturities of fixed maturities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,316 4,869 5,305

Proceeds from sales of investments:

Fixed maturities ................................................. 2,805 6,932 7,323

Equity securities ................................................. 65 53 106

Real estate..................................................... —25 11

Other investments ................................................ 511 655 1,460

Purchases of investments:

Fixed maturities ................................................. (9,647) (11,127) (14,719)

Equity securities ................................................. (24) (95) (135)

Real estate..................................................... (15) (38) (74)

Other investments ................................................ (349) (667) (740)

Net sales (purchases) of short-term securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 370 (406) (562)

Securities transactions in course of settlement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 395 (318) (123)

Other ......................................................... (326) (45) (378)

Net cash used in investing activities .................................. (899) (162) (2,526)

Cash flows from financing activities

Payment of debt................................................... (143) (552) (1,956)

Issuance of debt................................................... 494 496 2,461

Dividends paid to shareholders ......................................... (693) (715) (742)

Issuance of common stock—employee share options . . . . . . . . . . . . . . . . . . . . . . . . . . . . 180 89 218

Treasury stock acquired—share repurchase authorization . . . . . . . . . . . . . . . . . . . . . . . . . (3,259) (2,167) (2,920)

Treasury stock acquired—net employee share-based compensation . . . . . . . . . . . . . . . . . . . (29) (29) (39)

Excess tax benefits from share-based payment arrangements . . . . . . . . . . . . . . . . . . . . . . . 810 25

Net cash used in financing activities ................................. (3,442) (2,868) (2,953)

Effect of exchange rate changes on cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 (29) 5

Net increase (decrease) in cash ......................................... (95) 79 (188)

Cash at beginning of period ........................................... 350 271 459

Cash at end of period ............................................... $ 255 $ 350 $ 271

Supplemental disclosure of cash flow information

Income taxes paid.................................................. $ 876 $ 841 $ 1,346

Interest paid..................................................... $ 385 $ 375 $ 357

See notes to consolidated financial statements.

164