Travelers 2009 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2009 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295

|

|

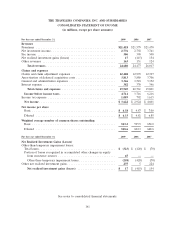

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

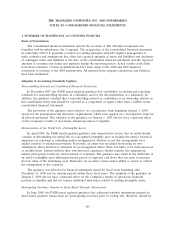

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements include the accounts of The Travelers Companies, Inc.

(together with its subsidiaries, the Company). The preparation of the consolidated financial statements

in conformity with U.S. generally accepted accounting principles (GAAP) requires management to

make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the consolidated financial statements and the reported

amounts of revenues and claims and expenses during the reporting period. Actual results could differ

from those estimates. Certain reclassifications have been made to the 2008 and 2007 financial

statements to conform to the 2009 presentation. All material intercompany transactions and balances

have been eliminated.

Adoption of Accounting Standards Updates

Noncontrolling Interests in Consolidated Financial Statements

In December 2007, the FASB issued updated guidance that established accounting and reporting

standards for noncontrolling interests in a subsidiary and for the deconsolidation of a subsidiary. In

addition, the guidance clarified that a noncontrolling interest in a subsidiary is an ownership interest in

the consolidated entity that should be reported as a component of equity rather than a liability in the

consolidated financial statements.

The provisions of the guidance were effective on a prospective basis beginning January 1, 2009,

except for the presentation and disclosure requirements, which were applied on a retrospective basis for

all periods presented. The adoption of the guidance on January 1, 2009 did not have a material effect

on the Company’s results of operations, financial position or liquidity.

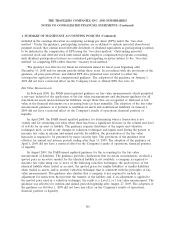

Determination of the Useful Life of Intangible Assets

In April 2008, the FASB issued updated guidance that amended the factors that an entity should

consider in determining the useful life of a recognized intangible asset to include the entity’s historical

experience in renewing or extending similar arrangements, whether or not the arrangements have

explicit renewal or extension provisions. Previously, an entity was precluded from using its own

assumptions about renewal or extension of an arrangement where there was likely to be substantial cost

or modifications. Entities without their own historical experience should consider the assumptions

market participants would use about renewal or extension. The guidance may result in the useful life of

an entity’s intangible asset differing from the period of expected cash flows that was used to measure

the fair value of the underlying asset. Disclosure of an entity’s intent and/or ability to renew or extend

the arrangement is also required.

The guidance was effective for financial statements issued for fiscal years beginning after

December 15, 2008 and for interim periods within those fiscal years. The adoption of the guidance on

January 1, 2009 did not have a material effect on the Company’s results of operations, financial

position or liquidity and did not require additional disclosures related to existing intangible assets.

Participating Securities Granted in Share-Based Payment Transactions

In June 2008, the FASB issued updated guidance that addressed whether instruments granted in

share-based payment transactions are participating securities prior to vesting and, therefore, should be

165