Travelers 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the Bond & Financial Products group, net written premiums in 2008 increased 1% over 2007

(adjusted for the sale of Afianzadora Insurgentes), as the impact of the higher level of business

retained in 2008 was largely offset by a decline in premium volume due to competitive market

conditions and the economic downturn. In the Bond & Financial Products group (excluding the surety

line of business, for which the following are not relevant measures), business retention rates in 2008

remained strong and increased slightly over 2007. Renewal price changes in 2008 were slightly negative,

compared to an increase in the prior year, and new business levels were consistent with 2007.

Net written premiums in the International group in 2008 were flat with 2007. For the International

group in 2008, business retention rates declined from 2007 due to the intentional non-renewal of

certain property business in Canada and more competitive market conditions at Lloyd’s. Renewal price

changes in 2008 were flat, compared to a decrease in 2007, and new business volume increased.

Gross and net written premiums in 2007 increased 1% and 2%, respectively, over 2006. Adjusting

for the sale of Afianzadora Insurgentes, gross and net written premiums increased 3% and 4%,

respectively, over 2006. Net written premiums in the Bond & Financial Products group in 2007

increased 1% over 2006 (adjusted for the sale of Afianzadora Insurgentes), primarily due to increased

construction surety business volume resulting from strong economic conditions in the public works

sector of the construction industry. For Bond and Financial Products (excluding the surety line of

business), business retention rates in 2007 increased over 2006. Renewal price changes in 2007 were

positive but down from 2006, and new business levels declined due in part to competitive market

conditions. In the International group, net written premiums in 2007 increased $99 million, or 9%, over

2006, primarily reflecting the favorable impact of foreign currency exchange rates and strong business

volume at Lloyd’s and in Canada. Net written premium volume in the International group in 2007 also

benefited from adjustments to prior year premium estimates in the Lloyd’s operation. In the

International group in 2007, business retention rates remained strong, new business volume increased

over 2006, and renewal price changes declined from 2006.

Personal Insurance

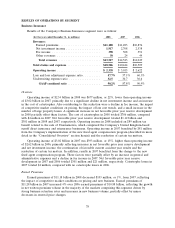

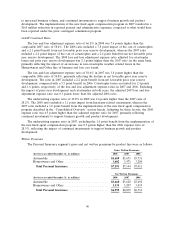

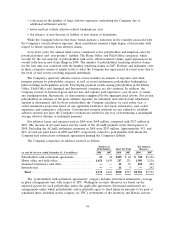

Results of the Company’s Personal Insurance segment were as follows:

(for the year ended December 31, in millions) 2008 2007 2006

Revenues:

Earned premiums .......................... $6,970 $6,803 $6,563

Net investment income ...................... 421 559 548

Other revenues ............................ 75 90 94

Total revenues ............................. $7,466 $7,452 $7,205

Total claims and expenses ...................... $6,855 $5,996 $5,555

Operating income ............................ $ 465 $1,019 $1,132

Loss and loss adjustment expense ratio ............ 66.2% 58.6% 54.8%

Underwriting expense ratio ..................... 30.8 28.2 28.3

GAAP combined ratio ....................... 97.0% 86.8% 83.1%

Overview

Operating income of $465 million in 2008 was $554 million, or 54%, lower than operating income

in 2007, primarily reflecting an increase in the cost of catastrophes. Also contributing to the decline in

2008 were the impact of a reduction in net investment income, an increase in non-catastrophe related

weather losses and loss cost trends. The cost of catastrophes in 2008 totaled $618 million, compared

87