Travelers 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.price changes were slightly negative in 2008, and were lower than in 2007. New business levels also

declined when compared with 2007, reflecting competitive market conditions in this market.

Net written premiums of $2.52 billion in 2007 grew 6% over 2006, primarily driven by an increase

in new business volume, coupled with continued strong business retention rates. The growth in new

business volume reflected the impact of product introductions, additional products sold to existing

customers and increased marketing efforts. Renewal price changes in this market declined from 2006

and were negative in 2007, primarily reflecting competitive market conditions.

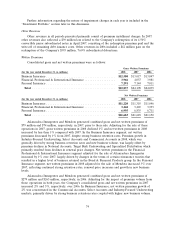

National Accounts. Net written premiums of $1.00 billion in 2008 decreased 6% from 2007. The

decline primarily reflected a significant decline in renewal price changes, as the price charged for

National Accounts’ products is adjusted based on actual loss performance, which continues to be

favorable due to workers’ compensation reforms. Overall new business volume increased slightly over

2007. Business retention rates in 2008 remained strong and increased over 2007.

Net written premiums of $1.06 billion in 2007 declined 7% from 2006, primarily reflecting

competitive market conditions that resulted in lower business volume.

Industry-Focused Underwriting. Net written premiums of $2.40 billion in 2008 increased 4% over

2007. All business units in this market recorded net written premium growth in 2008. Growth in

Construction net written premiums in 2008 was driven by strong business retention levels coupled with

continued strong new business volume. An increase in new business volume was the primary factor in

the growth in net written premiums in the Oil & Gas business unit. In Agribusiness, net written

premium growth was driven by increases in business retention rates and renewal price changes. In the

Public Sector business unit, the increase in net written premiums was driven by higher new business

volume coupled with continued strong business retention rates.

Net written premiums of $2.30 billion in 2007 increased 5% over 2006. The increase was driven by

the Construction business unit, where favorable economic conditions contributed to higher new business

volume; the Oil & Gas business unit, due to increased business retention rates and strong renewal price

changes; and the Public Sector unit, due to an increase in retention rates. In addition, strong new

business volume and business retention rates in the Agribusiness business unit contributed to premium

growth in 2007. Net written premiums in the Technology business unit in 2007 were level with 2006.

Target Risk Underwriting. Net written premiums of $1.59 billion in 2008 decreased 4% from 2007.

The decline was concentrated in the National Property business unit, reflecting reductions in renewal

price changes and new business volume due to competitive market conditions, and in the Inland

Marine business unit, primarily reflecting reductions in business retention rates and new business

volume due to general economic conditions. In addition, the Global Accounts business unit experienced

a reduction in net written premiums due to declines in business retention rates, renewal price changes

and new business. Partially offsetting the declines in these business units was an increase in net written

premiums in the Excess Casualty business unit, where renewal price changes remained negative but

improved over 2007 and business retention levels increased.

Net written premiums of $1.67 billion in 2007 grew 2% over 2006, driven by increases in the

Inland Marine and National Property business units. Strong growth in new business volume accounted

for the increase in Inland Marine net written premiums, whereas National Property’s premium growth

was driven by continued strong business retention rates and a decline in premiums ceded for

catastrophe reinsurance coverage, partially offset by a decrease in renewal price changes, which were

negative. Growth in these two business units was partially offset by a decline in Excess Casualty net

written premiums.

Specialized Distribution. Net written premiums of $939 million in 2008 decreased 7% from 2007.

The premium decline reflected negative renewal price changes in both the Northland and National

83